LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

For a year, the Fed kept jawboning about how inflation would be "transitory" because of near-term supply issues.

Why did they keep that up?

Easy: signaling and liquidity.

If the US spends trillions in fiscal stimulus, it helps to have a loose monetary policy. That makes the cost of that spending go down, thanks to lower interest rates.

That ripples through to the economy and the stock market…

And for those saying that the Fed doesn't care about stock prices, that's OK too. My daughter also believes in fairy tales when I read them to her.

So while the Fed has been forcing the transitory language, we kept seeing inflation pop up.

We’ve talked about some of the economic and market effects in our “empty shelves” series.

But let’s look at some markets as they stand now.

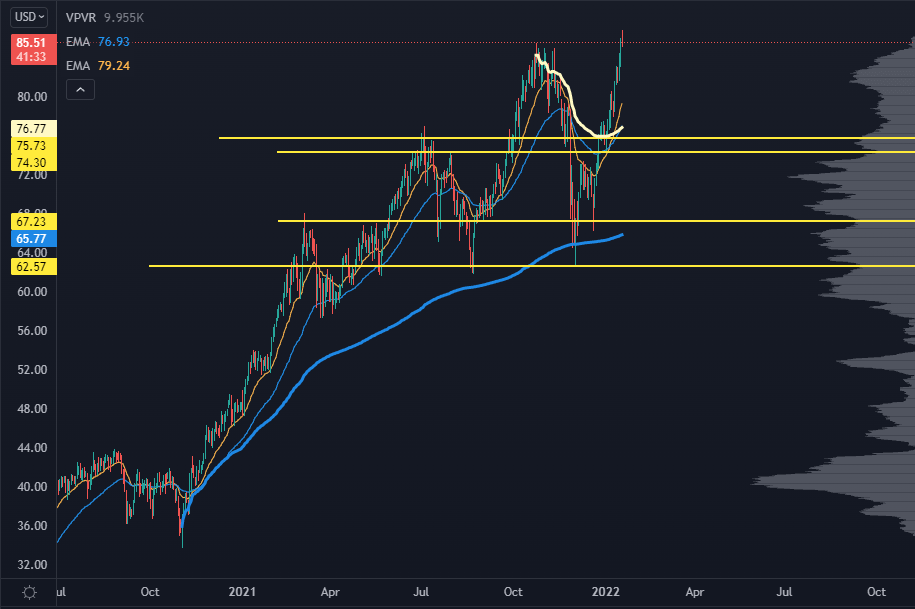

Crude oil’s doubled from summer 2020:

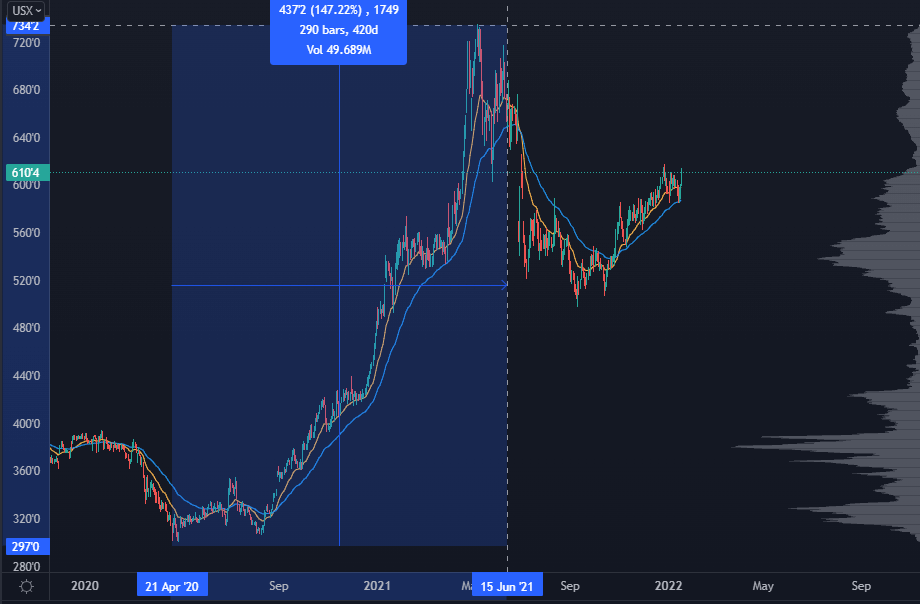

Corn futures saw a run of about 150% off the 2020 lows:

Crude Oil Futures Chart

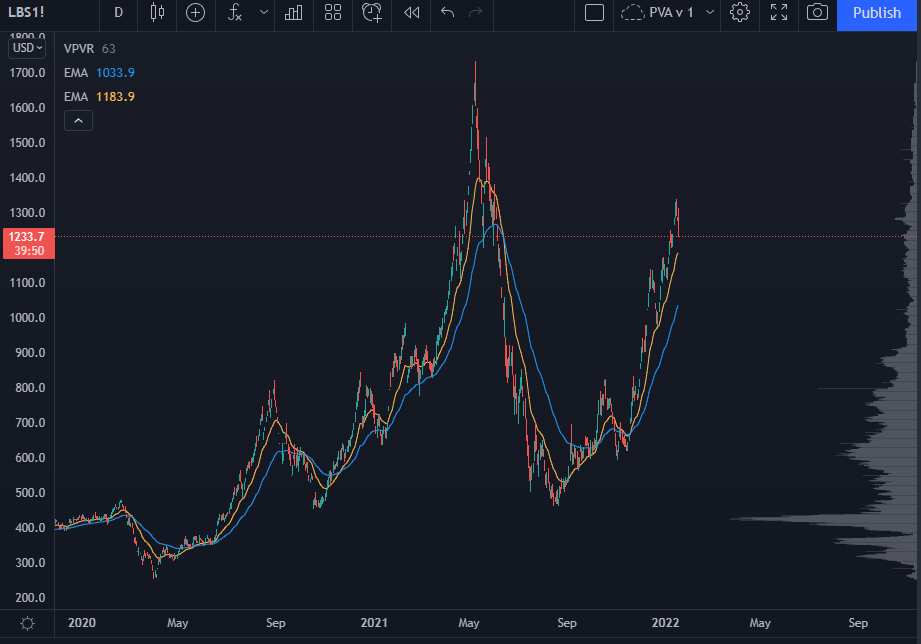

And lumber saw 2 massive runs:

Crude Oil Chart

It was only a matter of time before the Fed had to change their posturing…

And in November, the Chairman of the Fed changed the signaling to a much more hawkish stance.

Now, here's the thing about interest rates:

During different "rate regimes," certain sectors do better than others.

When you have a very loose monetary policy, with interest rates set at zero, funds will simply pile into high growth stocks and chase momentum.

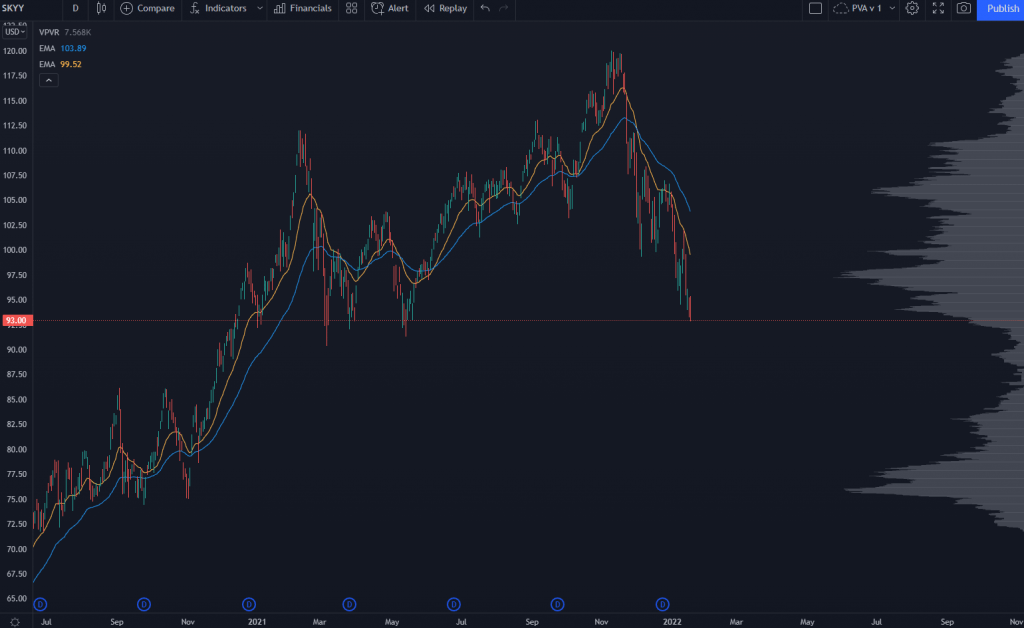

This is a chart of SKYY, which is a cloud computing ETF:

SKYY ETF Chart

Do you want to take a guess where Chairman Powell changed his posture? Yup. Right at the top.

That trade is broken, leaving a trail of financial carnage in its wake.

So where do we go now?

Here's another clue for you. It's the relative change in IWO and IWN.

IWO is small-cap growth, while IWN is small-cap value.

The best way to view the changes in Fed policy is to follow the Fed Fund Futures market. It consists of people betting on the likelihood of rate hikes in any given time in the future.

In 2020, growth stocks went absolutely crazy due to a combination of a fiscal money drop and loose monetary policy.

Now that rates are going up, that trade has broken, and value plays are where you should start focusing.

One problem:

Trading value stocks is hard.

It requires a deep-dive on the actual business behind the stock, with excel spreadsheets and DCF models.

I'm not going to do that work…

But we know who will.

What market participants have every single piece of data available for a company?

Where they know their sales numbers the minute they come in…

And they know when their company is deeply undervalued?

The insiders. That’s who.

They're the only folks with non-public information about their companies.

They have the most up-to-date financial models.

And when they buy their stock on the open market, it gives us an early signal about a stock ready for a material change in the fundamentals.

That's why we follow insiders.

The liquidity punchbowl is being pulled away. Companies won't be able to borrow at low rates to buy back their own stock.

Any stock that was running at a high sales multiple has been crushed.

And the major indices have barely been hit.

Things are about to get interesting.

So if you're looking for solid, reliable investments backed by statistical research…