LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

We've heard for a few weeks about Elon Musk’s Twitter takeover.

And to be honest, I'm all about it. It's got the right people spooked. In fact, the Feds are so concerned about people speaking freely…

They created a Ministry of Tru — *ahem* pardon me, "Disinformation Board" within the Department of Homeland Security.

I wish they’d stop using Orwell’s 1984 as an instruction manual.

But back to Twitter: Elon’s buyout price is $54.20/share... but the stock is trading at $49.

What gives? Couldn’t you just buy the stock right here and catch a quick $5/share profit?

Not so fast — it gets tricky.

Welcome to the world of merger arbitration.

There's no guarantee this deal will get done. There's compliance, legal, and about 15 government departments that have to give the OK.

Here's a great example:

At the beginning of 2022, Microsoft (MSFT) announced it would buy out Activision (ATVI) for $95 per share, all cash, for a total of $68.7 billion.

ATVI is currently trading under $80/share.

The difference between those two prices is the "risk premium" in the deal.

The higher the risk premium, the lower the odds of the deal going through.

In the ATVI/MSFT case, the Feds could launch antitrust lawsuits that could kill the deal, so the stock trades at a discount relative to the acquiring price.

TWTR has the same kind of mechanic. There's no guarantee this deal is done until the owners of the stock see cash replace their shares in their accounts.

The important question in all this: Can we profit from it?

It's a tough call. If the deal doesn't go through, you'll probably see a hard selloff back to $40/share as traders will need to get blown out before the stock can bottom.

We likely won’t see a higher takeover price, because... well... Twitter as a business is a bit of a clown show.

The stock hasn't had any return since the IPO.

The real value is the political value — similar to how Jeff Bezos bought the Washington Post or how Carlos Slim bailed out the NYT.

If $54.20 is the only buyout price, we'll probably see that reflected in the options market.

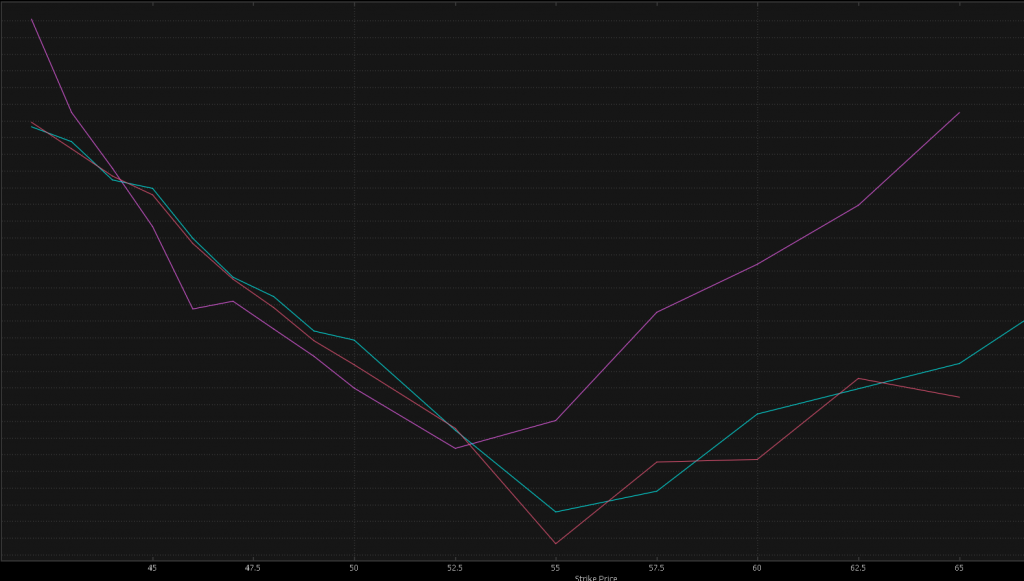

Here's the options skew curve for TWTR options. We’re looking at June, August, and September expirations.

As you can see, implied volatility on the 55 strike is lowest for August and September. There's some risk premium baked into June options, but it's slight.

This means there isn't a real "layup" in buying the calls because if the deal gets done, all the premium evaporates.

Let's look at an example.

Say someone buys the June 50 call for 1.40. We know the buyout price is 54.20, so their profit will be the buyout price less the strike and premium:

54.20 - 1.40 - 50 = 2.80

Not bad. That means you could potentially earn $280 per contract if the deal gets done by June.

But if it doesn't — if there are more hoops to jump through — then you'll lose the entire value of your call option.

What are the odds the Federal government allows this deal to go through in the next 45 days? Especially after creating their Disinformation Board?

I think it's low.

Now, I do have a fairly advanced options trade to consider as a way to play this.

I bet we’ll probably see a deal done, but the Feds or other powerful entities could try to kill it along the way, leading to a few panicky situations. This can lead to more price volatility than what people are expecting.

This trade is known as a time spread sale, or a calendar spread sale.

It's not a trade you see many retail traders take, but institutions often use it — especially when trading futures.

Consider this trade:

1. Buy to Open TWTR Aug 49 Put

2. Sell to Open TWTR Oct 49 Put

This requires a little bit of margin on the trade since the short option’s on the back month.

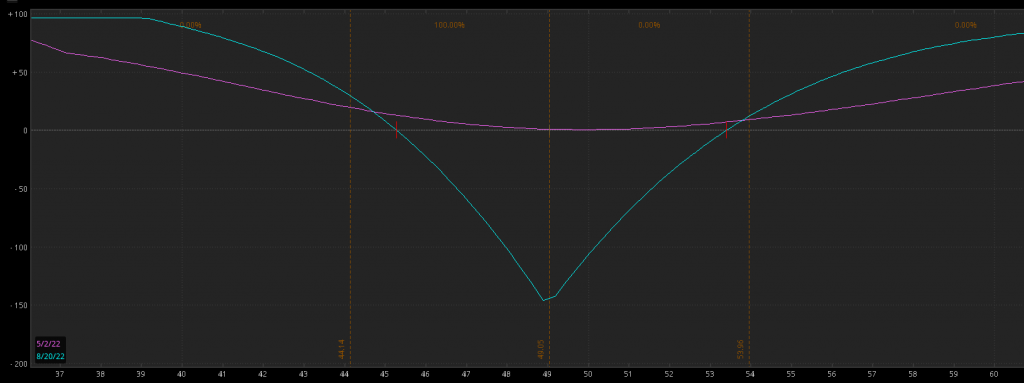

Here’s what the setup looks like:

TWTR is currently trading at 49. If the stock is trading either below 45 or above 53 into August options expiration, the trade will potentially make money.

The most interesting part is that if the deal goes through, the option premiums will drop to zero. This is a "short vega" trade, meaning it benefits if the premiums drop.

To illustrate: Let's say a deal is completed and TWTR runs to 54.

Both options will end up with a value of 0, which means that you can collect a credit of 1.00.

That's a pretty good return on this kind of spread…

But the added benefit is if someone tries to spike the deal, then we can easily see a push sub 45 before August hits — and this position would directly benefit from that kind of move. I wouldn't be surprised by a push to the low 40s on a broken deal, so the profit potential’s there.

The main risk is if TWTR trades at 49 all the way through August.

I think that's unlikely, so the risk priced into the options market is lower than what the market is currently pricing.

Overall, I hope this deal goes through. And fast. Not just for the profit potential — but I do enjoy seeing all the right people get mad about free speech coming back to Twitter.

Oh, one more thing:

On Saturday, I was one of six market experts that presented at an online event. My presentation was about “How to Focus and Trade the Best Stocks in the Market.”

If you missed it, I’ve got the replay right here for you:

>>>WATCH NOW: How to Focus and Trade the Best Stocks in the Market<<<