Michael Aaron

This is hands down

"The Most Valuable Piece Of Paper On Wall Street"

Presented by Michael Aaron & Steven Place

Steven Place

This is hands down

"The Most Valuable Piece Of Paper On Wall Street"

Presented by Michael Aaron & Steven Place

Michael Aaron

Steven Place

How To Ethically Steal Trade Ideas From the World's Most Successful Investors

michael

Hello Everyone and welcome, my name is Michael Aaron and today I have a very special guest.

He has been trading professionally for well over a decade and you have probably heard his name or seen his face on Mad Money, CNBC, Forbes, or any number of other well known outlets.

A man who really doesn't need an introduction in the Investing world

My special guest today is none other than Steven Place.

Steven, how the heck are you man?

He has been trading professionally for well over a decade and you have probably heard his name or seen his face on Mad Money, CNBC, Forbes, or any number of other well known outlets.

A man who really doesn't need an introduction in the Investing world

My special guest today is none other than Steven Place.

Steven, how the heck are you man?

Steven

I am doing great, Michael. Thanks for the warm welcome and it's great to be here.

michael

Steven, can you share with our audience what you have for us today.

steven

Absolutely Michael, today I want to share with you and your audience what I believe is the most valuable piece of paper on wall street.

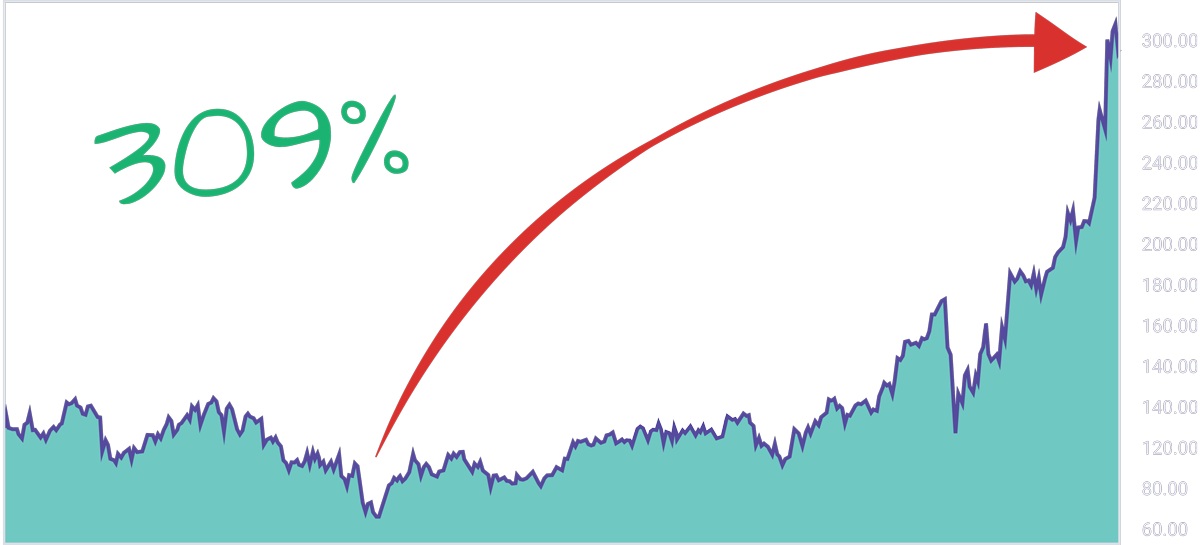

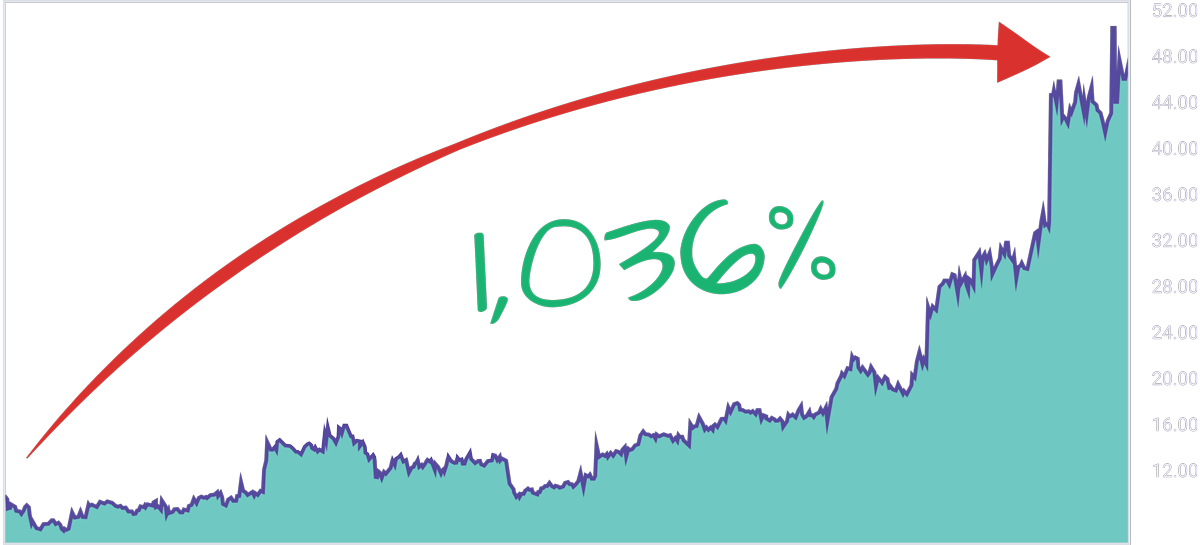

The information on it would have enabled you to buy KSU for a 309% gain...

The information on it would have enabled you to buy KSU for a 309% gain...

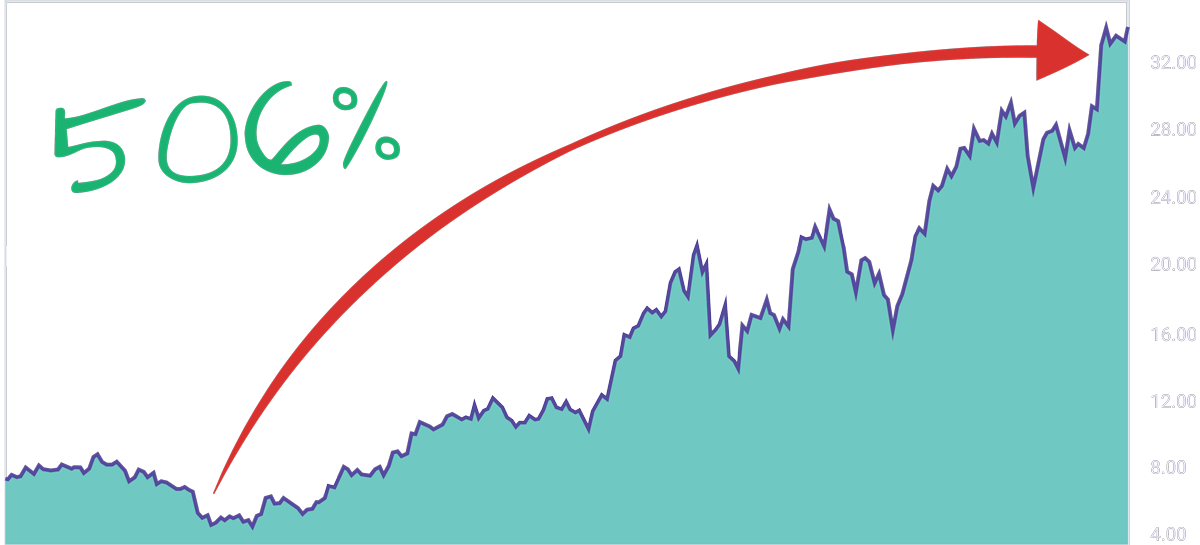

NMI Holdings for a 506% gain...

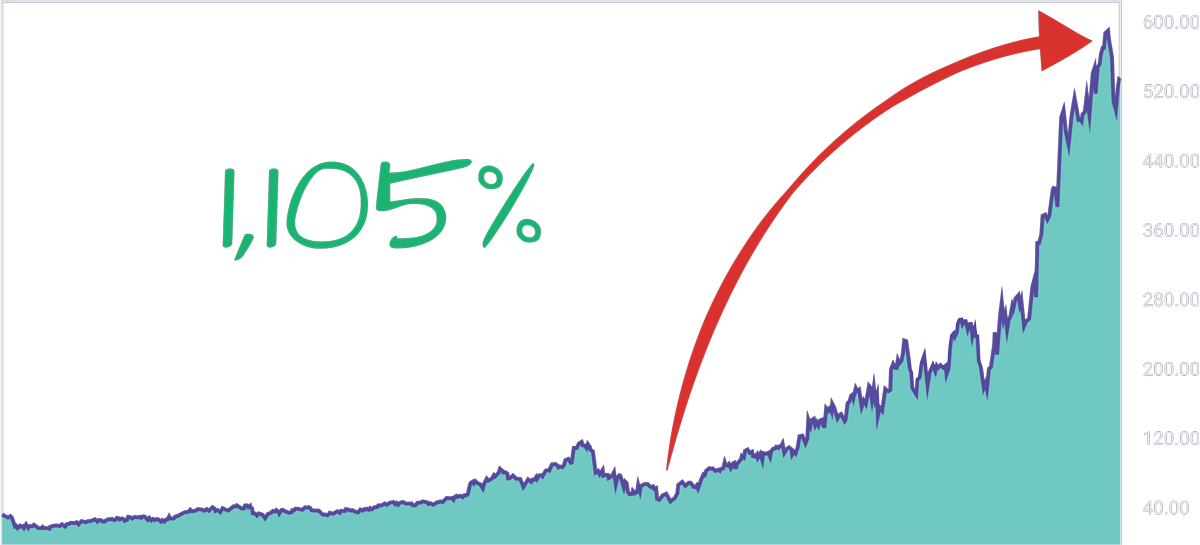

And ZEBRA Technologies for a whopping 1,105% Gain!

What's in this envelope represents unfathomable information.

Imagine knowing what a company's earnings are before they release it.

Whether or not a new drug trial is going well.

Upcoming mergers or acquisitions.

This document represents just that.

It enables anyone regardless of time availability or experience to potentially find pre-breakout stocks Without all the complexities that come with Technical or Fundamental Analysis.

It is the closest thing I have ever seen to a crystal ball.

And today I am going to share it with all of you.

Steven

I would like to say that if you have ever found yourself struggling to find success as an investor or trader, this is understandable.

The stock market isn't the high-roller table in Vegas.

It's more like some sketchy back alley poker game where everyone seems to know every card you're holding and they are robbing you blind.

In short, the market is somewhat rigged against you.

Most of the hugely successful investors we are going to take a look at today are doing something very different then what you have probably been doing.

All that to say if you have struggled in the past with your Investing… It's probably not your fault.

And today, if you're willing… I think we can change that.

Because today, I am going to Expose a group of traders who buy stocks with laser-like accuracy.

And these elite investors often see their stocks move 200, 500, heck even 1,000 percent or more shortly after they enter the market.

I mean it's almost like they can see the future

The stock market isn't the high-roller table in Vegas.

It's more like some sketchy back alley poker game where everyone seems to know every card you're holding and they are robbing you blind.

In short, the market is somewhat rigged against you.

Most of the hugely successful investors we are going to take a look at today are doing something very different then what you have probably been doing.

All that to say if you have struggled in the past with your Investing… It's probably not your fault.

And today, if you're willing… I think we can change that.

Because today, I am going to Expose a group of traders who buy stocks with laser-like accuracy.

And these elite investors often see their stocks move 200, 500, heck even 1,000 percent or more shortly after they enter the market.

I mean it's almost like they can see the future

michael

Steven, this is some pretty exciting stuff.

But tell us, how exactly are they getting into these stocks just before they make massive moves higher?

You joke about them seeing the future, but they are so accurate and so consistent it would seem they actually can see the future

But tell us, how exactly are they getting into these stocks just before they make massive moves higher?

You joke about them seeing the future, but they are so accurate and so consistent it would seem they actually can see the future

Steven

The truth is Michael, they kind of can.

You see… they are what the SEC calls Insiders.

CEO’s, CFO’s, Board members. These are all people who have non public inside information about the companies they work for.

And many times they do know what the future holds.

At Least for their company.

Upcoming earnings figures…

Results of an end phase trial…

An FDA approval just around the corner...

This is why we regularly see them buying with such impeccable accuracy.

You see… they are what the SEC calls Insiders.

CEO’s, CFO’s, Board members. These are all people who have non public inside information about the companies they work for.

And many times they do know what the future holds.

At Least for their company.

Upcoming earnings figures…

Results of an end phase trial…

An FDA approval just around the corner...

This is why we regularly see them buying with such impeccable accuracy.

michael

So wait a minute here. You're talking about Insider trading?

Steven

That's exactly what I am talking about.

michael

But that's illegal.

steven

That’s what they would have you believe.

But this is all to throw you off the scent of one of the most powerful strategies in the world.

A strategy that politicians and Executives alike use to become very wealthy.

And today I am going to expose the lie for what it is…

And the document that unlocks it all.

Take Ronald Erickson

Ronald is the Chairman of the board for a company called Know Labs.

He has a base salary of $180,000.

Yet somehow… Ronald is a millionaire.

Care to guess how?

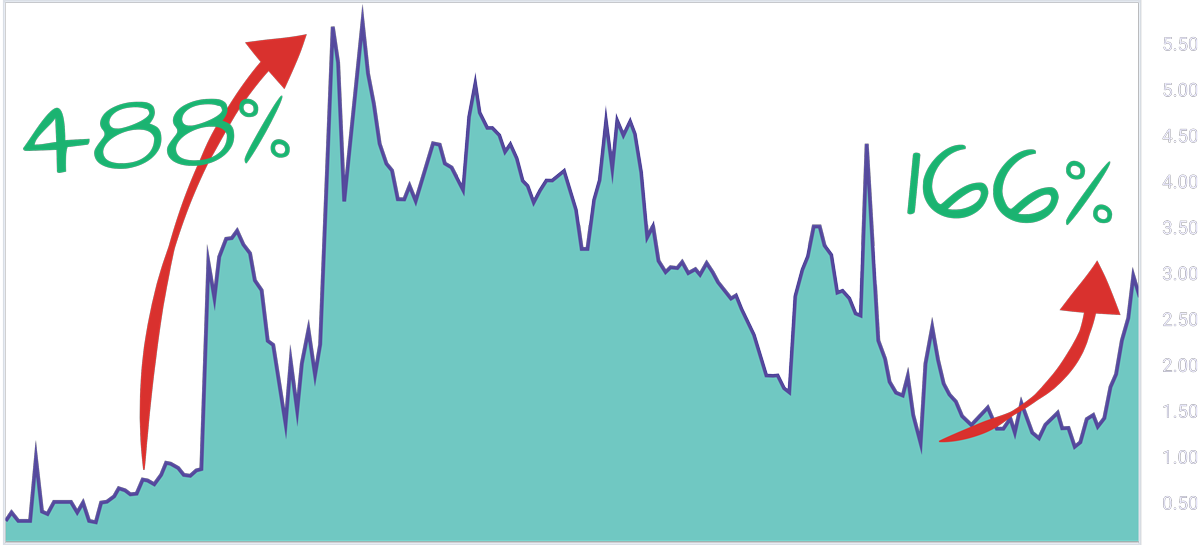

Ronald bought a significant amount of his company's stock… right before it launched… Twice!

But this is all to throw you off the scent of one of the most powerful strategies in the world.

A strategy that politicians and Executives alike use to become very wealthy.

And today I am going to expose the lie for what it is…

And the document that unlocks it all.

Take Ronald Erickson

Ronald is the Chairman of the board for a company called Know Labs.

He has a base salary of $180,000.

Yet somehow… Ronald is a millionaire.

Care to guess how?

Ronald bought a significant amount of his company's stock… right before it launched… Twice!

Ronald made a combined 1.5 million dollars.

But that is just the tip of the iceberg.

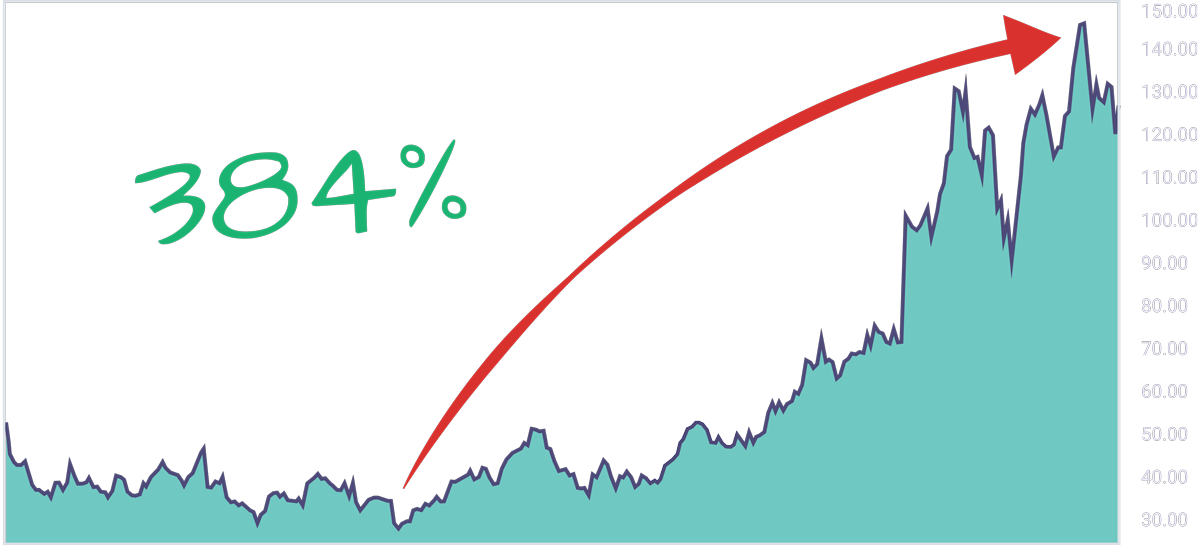

Five Below climbed 384% after insiders bought

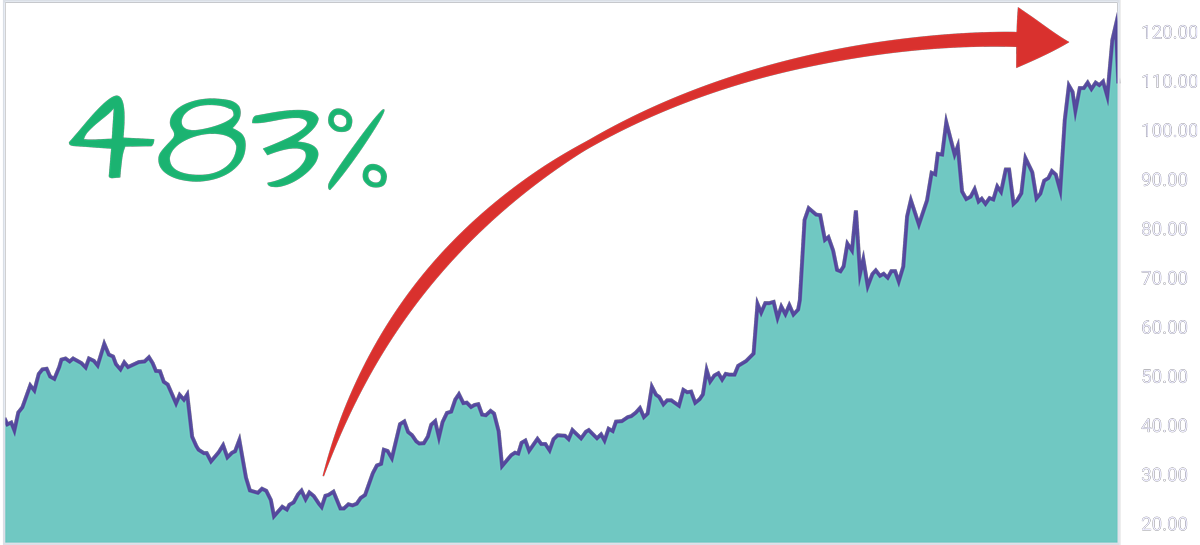

CRMT jumped 483%.

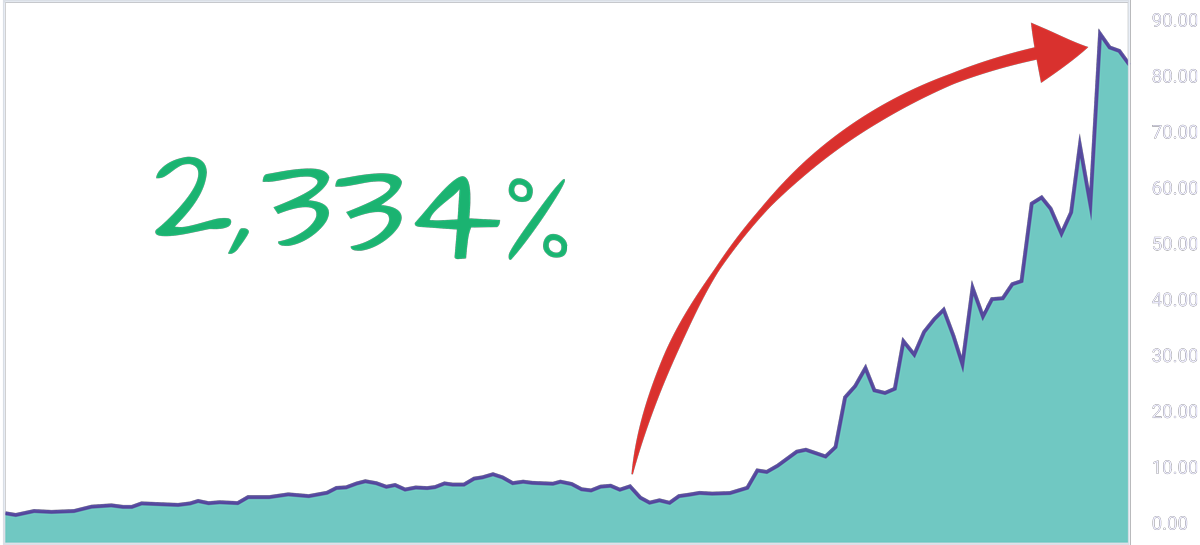

APPS climbed 2,334% following a big insider buy.

Enough to turn every $5,000 position into $116,000

It's the same with Politicians, You ever wonder how a public servant who makes a whopping 200k a year is sitting on hundreds of millions of dollars? They are on the inside of the system.

michael

So Steven, when we first spoke about doing this event. We were talking about how impossible it is for most traders to get into stocks before they move big.

Typically it's only after the news comes out and the stock has jumped that these breakout stocks even end up on people's radar.

But following these insiders kind of fixes that.

Typically it's only after the news comes out and the stock has jumped that these breakout stocks even end up on people's radar.

But following these insiders kind of fixes that.

Steven

Absolutely Michael and every one of the stocks we have just listed had massive insider buying just before they moved higher.

michael

That is truly incredible. You also mentioned a few goals you had for this event?... Can you cover those real quick?

Steven

Of course, #1 is to prove to you and our audience that the only way to consistently buy pre-break out stocks is to follow these insiders and of course why this document is critical to that.

And I want to be upfront with my second goal. My second goal is to make sure everyone understands that joining my “Insiders Exposed” research service is the only way to follow the right insiders.

But first I need to set the stage. I think you mentioned that I used to be an engineer. And one day I was on my way to work. I lived in Orlando and driving to work absolutely sucked.

In fact it had become the bane of my existence. And I was sitting in traffic in what is starting to feel like a metal coffin on wheels when a colleague's comment flashed through my mind.

He jokingly pointed out that he had worked at the same company I was working at longer then I had been alive.

Keep in mind, I loathed my job, and that morning it hit me like a ton of bricks.

That was my life. I got up, put on clothes (that I hated wearing btw), made a miserable commute that I also hated, to get to a job that was going nowhere and yes you guessed it. That I hated.

I added it up and realized I was spending most of my life at a place I hated wearing clothes I hated doing a job I hated.

My chest got tight and I thought I was going to hyperventilate.

I actually had to pull the car over to the side of the road.

It was a scary time and in hindsight a little embarrassing to admit.

But at that point I was done. I couldn't stand the thought of doing it another day.

So I decided to start trading. Obviously there was a learning curve and in the beginning I was a bit scared.

I mean... would I be able to do it?

After all I was married and I left a really good paying job and I really didn't want to let my wife down.

But it turns out I was really good at trading and I enjoyed it. It was time consuming but that was ok because it was fulfilling, both in terms of profits and in the challenge of it..

I even started trading on the institutional side.

But then something happened.

A defining moment in my life.

My daughter was born.

And I want to be upfront with my second goal. My second goal is to make sure everyone understands that joining my “Insiders Exposed” research service is the only way to follow the right insiders.

But first I need to set the stage. I think you mentioned that I used to be an engineer. And one day I was on my way to work. I lived in Orlando and driving to work absolutely sucked.

In fact it had become the bane of my existence. And I was sitting in traffic in what is starting to feel like a metal coffin on wheels when a colleague's comment flashed through my mind.

He jokingly pointed out that he had worked at the same company I was working at longer then I had been alive.

Keep in mind, I loathed my job, and that morning it hit me like a ton of bricks.

That was my life. I got up, put on clothes (that I hated wearing btw), made a miserable commute that I also hated, to get to a job that was going nowhere and yes you guessed it. That I hated.

I added it up and realized I was spending most of my life at a place I hated wearing clothes I hated doing a job I hated.

My chest got tight and I thought I was going to hyperventilate.

I actually had to pull the car over to the side of the road.

It was a scary time and in hindsight a little embarrassing to admit.

But at that point I was done. I couldn't stand the thought of doing it another day.

So I decided to start trading. Obviously there was a learning curve and in the beginning I was a bit scared.

I mean... would I be able to do it?

After all I was married and I left a really good paying job and I really didn't want to let my wife down.

But it turns out I was really good at trading and I enjoyed it. It was time consuming but that was ok because it was fulfilling, both in terms of profits and in the challenge of it..

I even started trading on the institutional side.

But then something happened.

A defining moment in my life.

My daughter was born.

I knew I had to adapt my trading to get some of my time back.

I refused to not be around for my daughter, You see..

My father was a school teacher who was up at the butt crack of dawn and would be flat exhausted by the time he got home.

My mom was a nurse in the air force and would sometimes pull third shifts to help make ends meet.

They were always there for me, but like many parents, they didn't always have the time.

As you know, in most jobs you exchange time for money, and I was sick and tired of trading my time for money.

I wanted to be there for my daughter in ways my parents couldn’t..

I thought it would mean making less money but it had to be done. (BTW I was wrong about the making less money part)

So I started looking for ways to trade that did not require as much time. And one day I was testing a new strategy trading around earnings reports. These reports can impact stocks significantly.

I had looked at the technicals, I did a deep dive on the fundamentals and I knew this company was not set up at all for good news.

In fact, all the analysts and pundits were pretty much in agreement.

The CEO had been interviewed and seemed much more optimistic but it's his job to try and boost the stock value right.

So you have to take that with a grain of salt.

Earnings came and went and they had a very unexpected boost. No one could have foreseen it. (Almost no one)

I lost a ton but it was the best money ever lost.

By Chance a few weeks later I was looking over the company's finances and filings trying to make sense of it and stumbled on a corporate filing that showed where that CEO had actually bought a lot of the company's stock just weeks before this earnings report.

It was then it hit me. I realized that if I worked for a company I would never buy a bunch of stock like that unless I knew something.

And these people are not any different.

Why tie up a whole bunch of my own money in one stock.

Loyalty only goes so far.

So although I don't trust what a CEO says, I realized that I could trust what he does.

And so it began. My search for understanding and exposing the world of Insider Trading.

I refused to not be around for my daughter, You see..

My father was a school teacher who was up at the butt crack of dawn and would be flat exhausted by the time he got home.

My mom was a nurse in the air force and would sometimes pull third shifts to help make ends meet.

They were always there for me, but like many parents, they didn't always have the time.

As you know, in most jobs you exchange time for money, and I was sick and tired of trading my time for money.

I wanted to be there for my daughter in ways my parents couldn’t..

I thought it would mean making less money but it had to be done. (BTW I was wrong about the making less money part)

So I started looking for ways to trade that did not require as much time. And one day I was testing a new strategy trading around earnings reports. These reports can impact stocks significantly.

I had looked at the technicals, I did a deep dive on the fundamentals and I knew this company was not set up at all for good news.

In fact, all the analysts and pundits were pretty much in agreement.

The CEO had been interviewed and seemed much more optimistic but it's his job to try and boost the stock value right.

So you have to take that with a grain of salt.

Earnings came and went and they had a very unexpected boost. No one could have foreseen it. (Almost no one)

I lost a ton but it was the best money ever lost.

By Chance a few weeks later I was looking over the company's finances and filings trying to make sense of it and stumbled on a corporate filing that showed where that CEO had actually bought a lot of the company's stock just weeks before this earnings report.

It was then it hit me. I realized that if I worked for a company I would never buy a bunch of stock like that unless I knew something.

And these people are not any different.

Why tie up a whole bunch of my own money in one stock.

Loyalty only goes so far.

So although I don't trust what a CEO says, I realized that I could trust what he does.

And so it began. My search for understanding and exposing the world of Insider Trading.

michael

And what did you find?

Steven

A freaking ATM machine.

But then reality set it in. I started mining the SEC database for these filings but it was very cumbersome and took hours and hours of research to find even one quality setup.

I literally had to search by day and then by company. Lets put a GIF of the scrolling through the data base

And not every trade was even worthwhile.

I was pretty devastated. You ever have a super high followed by a super low? That's how I felt.

Its kind of like thinking you have a winning lotto ticket only to find out you actually were watching last week’s numbers.

I knew the profit potential here, and the key was identifying the elite insiders who were betting on explosive upside.

But it felt like it was going to be impossible. A needle in a haystack.

With over 1000 filings to go through every day there was no way I could do this and still have time to sleep, eat, and spend time with my family.

So I sought out automation and developed a process of identifying the most lucrative opportunities and now I can know in a matter of minutes what the best opportunities are.

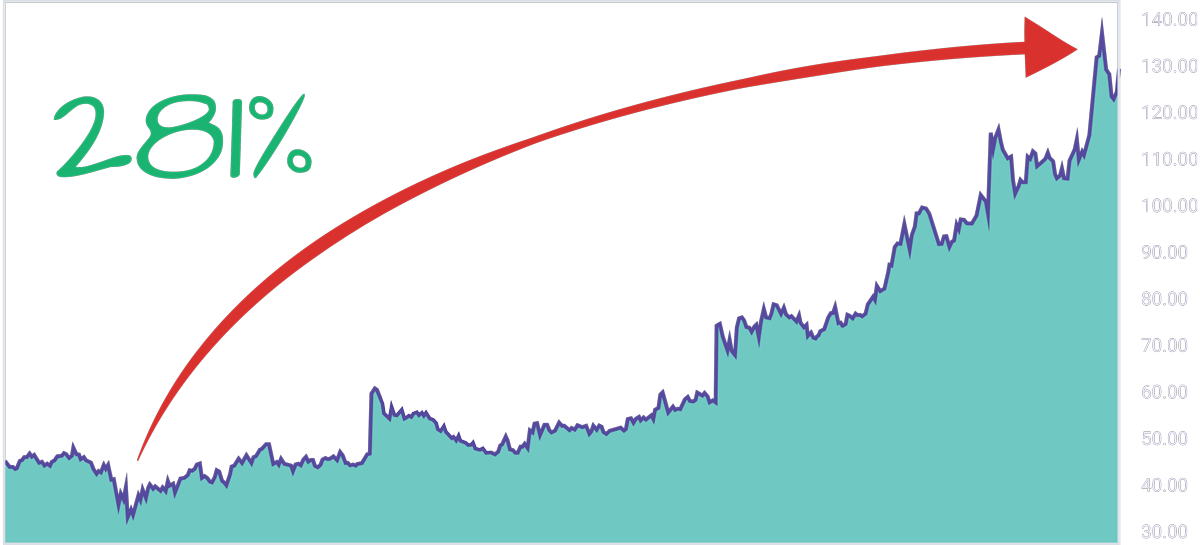

Opportunities like HCI that moved 281% after insiders bought

But then reality set it in. I started mining the SEC database for these filings but it was very cumbersome and took hours and hours of research to find even one quality setup.

I literally had to search by day and then by company. Lets put a GIF of the scrolling through the data base

And not every trade was even worthwhile.

I was pretty devastated. You ever have a super high followed by a super low? That's how I felt.

Its kind of like thinking you have a winning lotto ticket only to find out you actually were watching last week’s numbers.

I knew the profit potential here, and the key was identifying the elite insiders who were betting on explosive upside.

But it felt like it was going to be impossible. A needle in a haystack.

With over 1000 filings to go through every day there was no way I could do this and still have time to sleep, eat, and spend time with my family.

So I sought out automation and developed a process of identifying the most lucrative opportunities and now I can know in a matter of minutes what the best opportunities are.

Opportunities like HCI that moved 281% after insiders bought

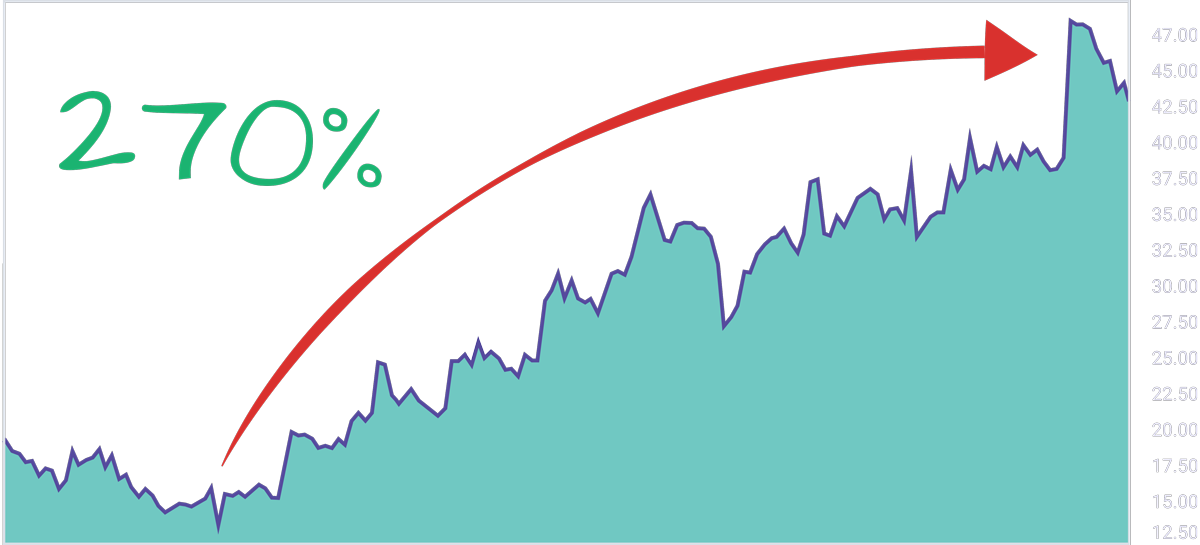

RVN that moved 270%

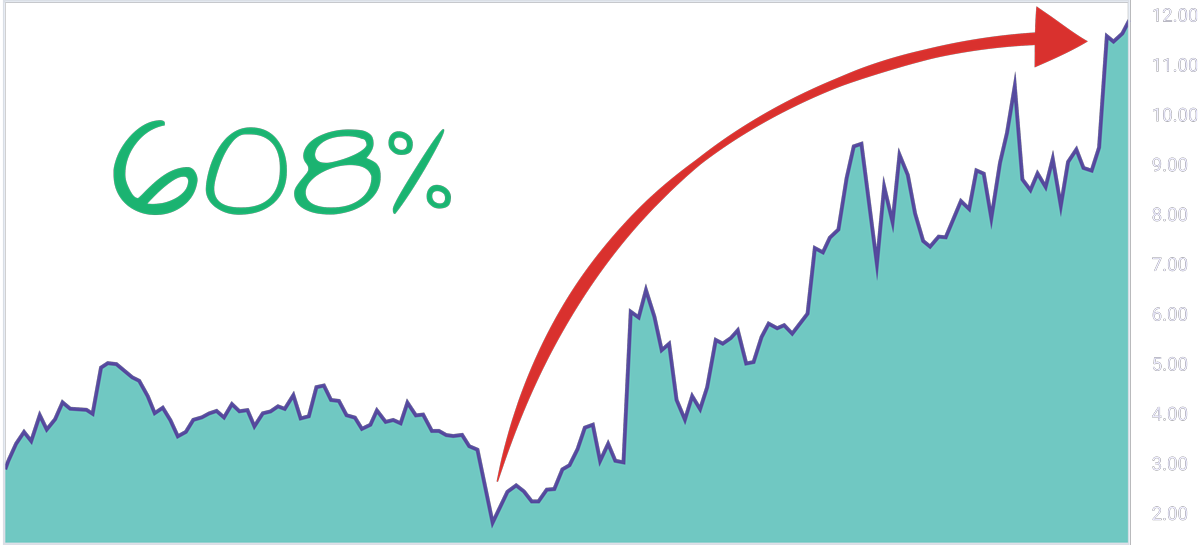

and MXC that moved a whopping 608%.

And by the end of the event you are going to have everything you need to follow these insiders too.

michael

Steven, those are some huge gains. But your going to have to clear some things up for me. In fact. Let's start with what this document is and how in world this is legal.

"How to ethically steal 740 million dollars in profitable trade ideas from the world's most successful investors".

Steven

Sure Michael, I want to break this down into three bite size sections And we are going to cover that in section one. As well as how to know when they trade, and a few advantages we have over these Insiders.

I call this section "How to ethically steal 740 million dollars in profitable trade ideas from the world's most successful investors".

In my initial study of these insiders I found almost 750 million dollars worth of profitable insider trades.

These are the best of the best, and in this section I am going to show you how to ethically and legally steal their trades.

Then we will move into section two “How to filter that information to find 1,000%+ Winners” In this section I am going to walk you through a very simple process for identifying which of these trades are worth taking.

And in the next section, 3 Stocks With Massive Insider Buying In Them Right Now, and how to own them”

I am going to show you the research on 3 trades that meet all these requirements as well as how you can get your hands on them and 3-5 other trades opportunities per month even if you don’t have time to do the research yourself.

I call this section "How to ethically steal 740 million dollars in profitable trade ideas from the world's most successful investors".

In my initial study of these insiders I found almost 750 million dollars worth of profitable insider trades.

These are the best of the best, and in this section I am going to show you how to ethically and legally steal their trades.

Then we will move into section two “How to filter that information to find 1,000%+ Winners” In this section I am going to walk you through a very simple process for identifying which of these trades are worth taking.

And in the next section, 3 Stocks With Massive Insider Buying In Them Right Now, and how to own them”

I am going to show you the research on 3 trades that meet all these requirements as well as how you can get your hands on them and 3-5 other trades opportunities per month even if you don’t have time to do the research yourself.

michael

This all sounds very exciting! Lets jump in

Steven

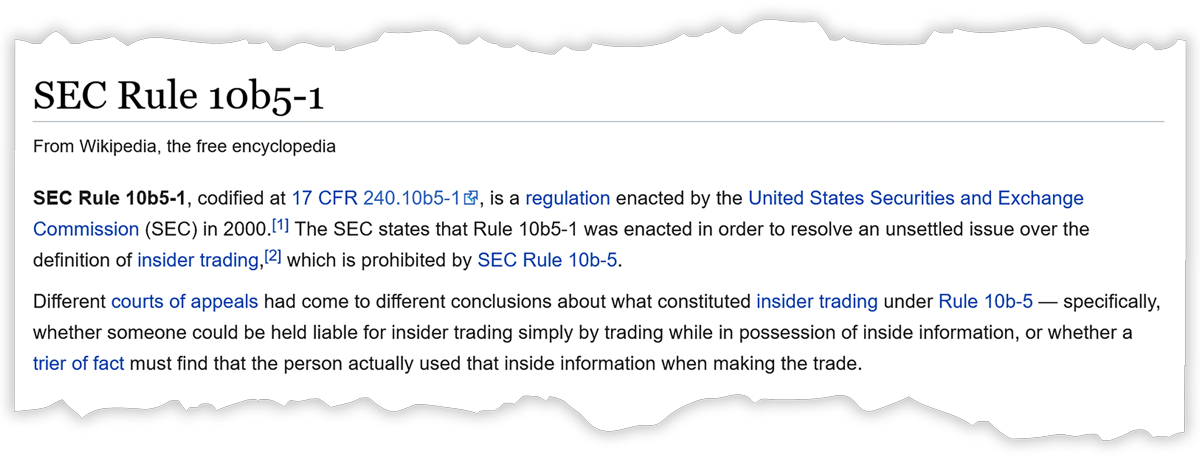

Let’s go back to the big loss I mentioned earlier, the one that lead me to the filing showing the CEO share purchases, I was confused.

After all, Insider Trading is Illegal right?

Well, After some digging I stumbled on this.

After all, Insider Trading is Illegal right?

Well, After some digging I stumbled on this.

U.S. SECURITIES & EXCHANGE COMMISION

Final Rule: Selective Disclosure and Insider Trading

Securities and Exchange Comission

17 CFR Parts, 240, 243, and 249

Release No. 33-7881, 34-43154, IC-24599, File No. S7-31-99

RIN 3235-AH82

Selective Disclsure and Insider Trading

17 CFR Parts, 240, 243, and 249

Release No. 33-7881, 34-43154, IC-24599, File No. S7-31-99

RIN 3235-AH82

Selective Disclsure and Insider Trading

In fairness this is just the heading to a document that seemed like it was a hundred pages long and it reads exactly like how a government regulation would.

But buried deep in this document is rule 10b5-1 and Wikipedia summarizes it like this.

But here’s the short version.

Insiders are basically immune from Insider trading violations as long as they keep one of these 10b5-1 trading “plans” on file with their broker.

You heard that right, it doesn't even have to be filed with the SEC and they can change the plan pretty much any time they want to.

It's a complete joke and it's no wonder we have politicians and executives working the system.

It is really easy to do.

Heck, the plan for why they are trading could be based on how their socks land on the bed when they dump their laundry out lol. They literally make up the rules for why they are entering.

And they can change the rules whenever they want.

Imagine getting pulled over for speeding and saying, no, actually I changed the speed limit last week.

Its a lot like that.

There is 1 thing they MUST do though. And that is to report their trades within 48 hours.

And that's where the magic happens.

Because let's be honest.

They are not really buying based on the way their socks land on the bed.

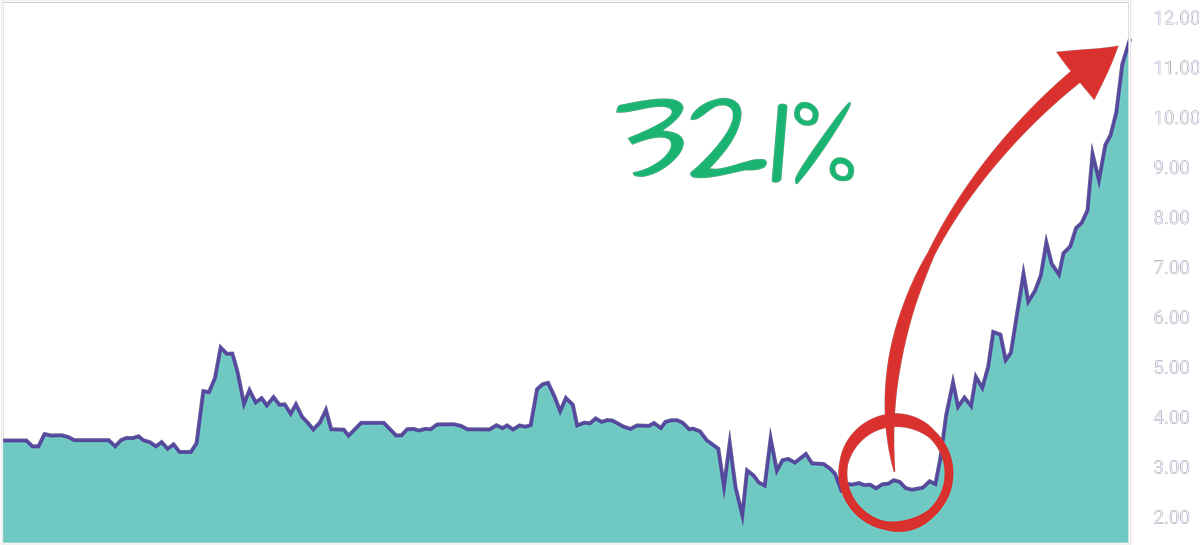

Take Planet Green Holdings...

The CEO and CFO bought over $5 million dollars each of their stock.

Two days later, they secured some long awaited financing needed to expand their operation.

Does anyone think this was luck?

Or is it more likely they knew that they had secured the financing?

In any case, this happened…

I know right, its crazy.

The market shot up 321 percent in two days.

The move came so quickly the exchange had to halt trading.

And there was nothing the SEC could do about it all thanks to SEC rule 10b5-1.

michael

Man, that's crazy, but doesn't that create an issue. I mean what if we get in and it turns out they were just trying to pump the stock up.

Steven

Ahh, the old pump and dump. That is typically with boiler room type brokerage houses who are buying up stock then pushing it to their clients only to bail when the stock is up.

These traders couldn’t do that if they wanted to. They have to follow the rules, what few there are.

And there is a rule found in SEC section 16b called the short swing rule.

And it requires them to hold their position for at least 6 months or forfeit their money.

These traders couldn’t do that if they wanted to. They have to follow the rules, what few there are.

And there is a rule found in SEC section 16b called the short swing rule.

And it requires them to hold their position for at least 6 months or forfeit their money.

SHORT SWING RULE SEC Section 16b

An insider is prohibited from “short-swing” transactions (i.e., a sale and purchase of company stock within a 6-month period).

The insider is required to surrender to the company all profits if such a “matching” transaction occurs.

The insider is required to surrender to the company all profits if such a “matching” transaction occurs.

But we could take a quick 320% and move on while they are stuck waiting to see what happens.

Now to be fair, when Insiders get in… the moves tend to be sustained.

Primarily because they know they have to stay in for 6 months.

This means they only get in when they expect the stock to go up and stay up.

michael

Well, let's back up a little here. I'm still not clear on how you find out about these trades.

The secret Document Revealed

Steven

That's the best part, the same rule that enables these insiders to trade their own stock. Requires them to report it within 48 hours.

They report it using a corporate filing.

These filings are public information and probably the most valuable piece of paper on wall street.

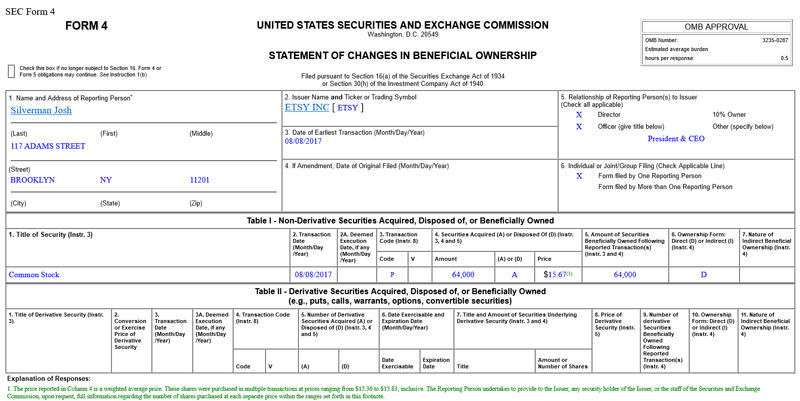

It's called a form 4 and they can be found on the SEC website in something called the Edgar database.

Let me show you what the form looks like...

They report it using a corporate filing.

These filings are public information and probably the most valuable piece of paper on wall street.

It's called a form 4 and they can be found on the SEC website in something called the Edgar database.

Let me show you what the form looks like...

That one is from Joshua Silverman. A quick glance shows us he is the CEO of Etsy.

We can also see he bought about 65,000 shares at 15.67 per share.

So he was buying at the market.

With his own money.

Now, Etsy recently hit $250 a share.

Remember… our insider bought 64,000 shares at around $15 bucks

Today they are worth nearly $250 each.

The more exciting news is that these forms are public information and you could have traded right alongside him.

And this happens all the time.

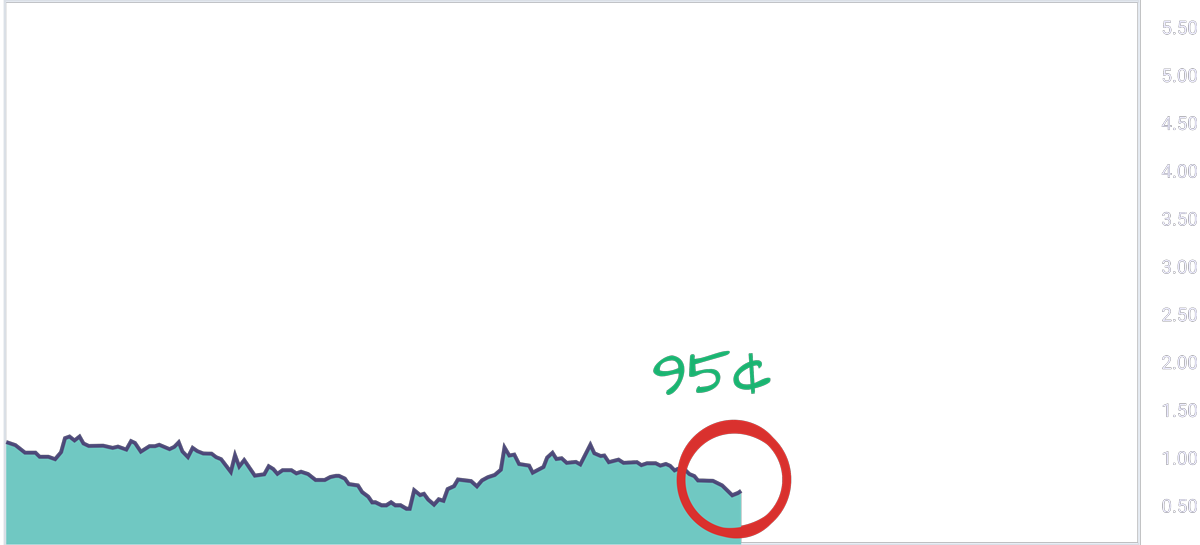

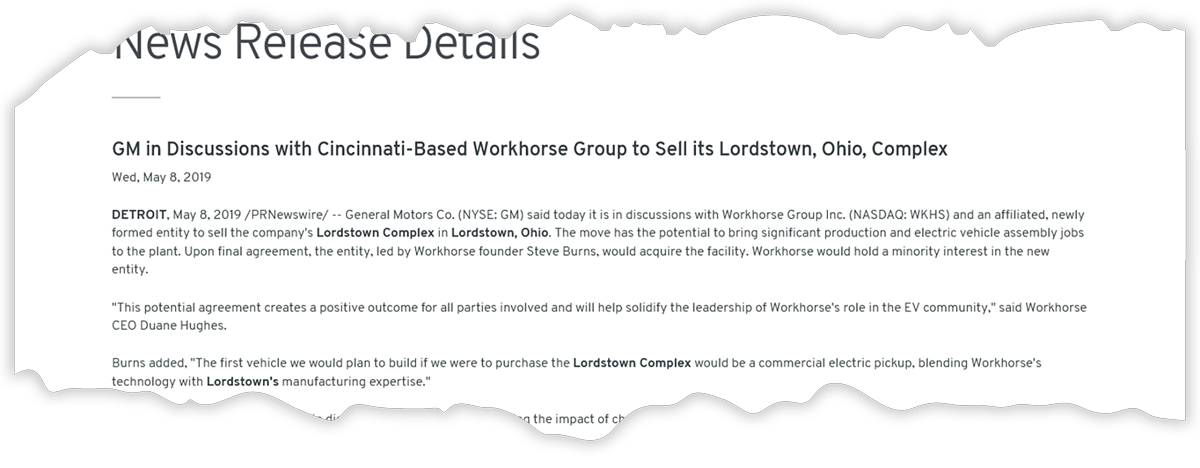

Just look at this tiny, micro-cap electric vehicle startup company called workhorse.

We saw two insiders buy the stock on the same day at just 95 cents a share.

Two months later... this happened…

The company announced it would be buying the Lords Town Motors facilities from GM.

The stock rallied nearly 500%!

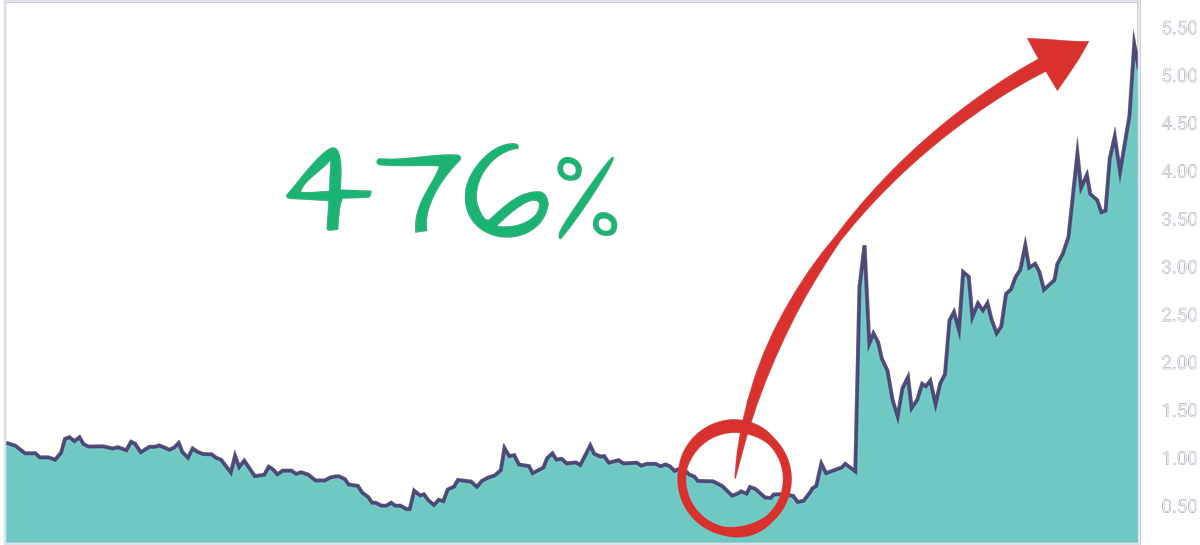

But that is just the beginning.

They were also finalizing the details with a new investor to secure a $70 million influx of cash.

They quickly put that capital to work on an electric delivery van and the market ate up the headlines.

The insiders were up over 3,000% in just over a year and the stock just wouldn't quit.

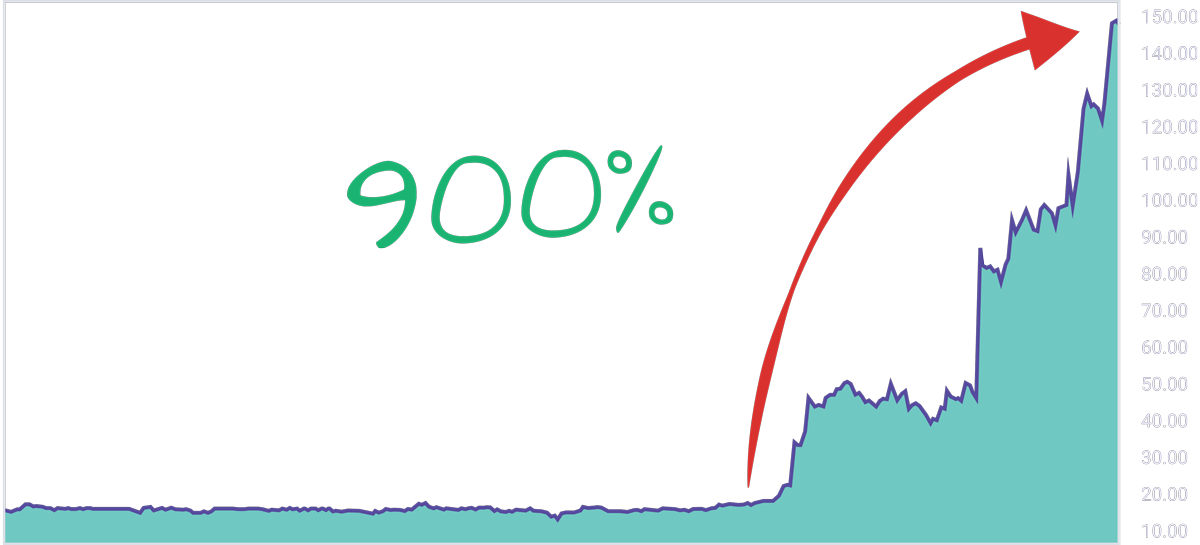

It went up another 900% over the following 12 months.

All in all they made nearly 4,000%.

And you could have traded right along side them.

Even a $2,000 investment would turn into $80,000

How many of you would invest $2,000 to make $80,000?

Are you starting to see why I call this the most valuable piece of paper on wall street?

The bottom line here is you CAN ethically steal these Insiders Trades for massive gains.

It’s totally legal. In fact, we are getting our trade ideas from the SEC website.

And we have an advantage over the insiders because of the short swing rule.

This is how you take back the power.

michael

Steven, I'm just thinking out loud here.

There are something like 4,000 publicly traded companies and each has multiple executives and board members who are probably buying and selling for any number of reasons.

Where do you even start?

There are something like 4,000 publicly traded companies and each has multiple executives and board members who are probably buying and selling for any number of reasons.

Where do you even start?

how to find 1000%+ winners

Steven

That’s a great question and a perfect segway into our next section. Which is...

“How to filter that information to find 1,000%+ Winners”

And Michael, it can be a lot of work. Which is of course why you should just let me do it for you.

But for those who want to dig deeper here is the short version.

I start by filtering out all the noise.

Things like institutional purchases or trust activity...

Option Exercises, most of those are just executives cashing in on options given to them by their company...

Scheduled buys, you probably have this where you work.

Every time you get paid you can choose to take some of your check and automatically buy some stock.

It doesn't really mean anything so we can throw that out as well.

I also discard any small purchases. If it doesn't show conviction I don't care about it.

These filters alone leave me with a much smaller list of transactions to look over.

And then it's just a matter of applying some basic filters to find the best opportunities.

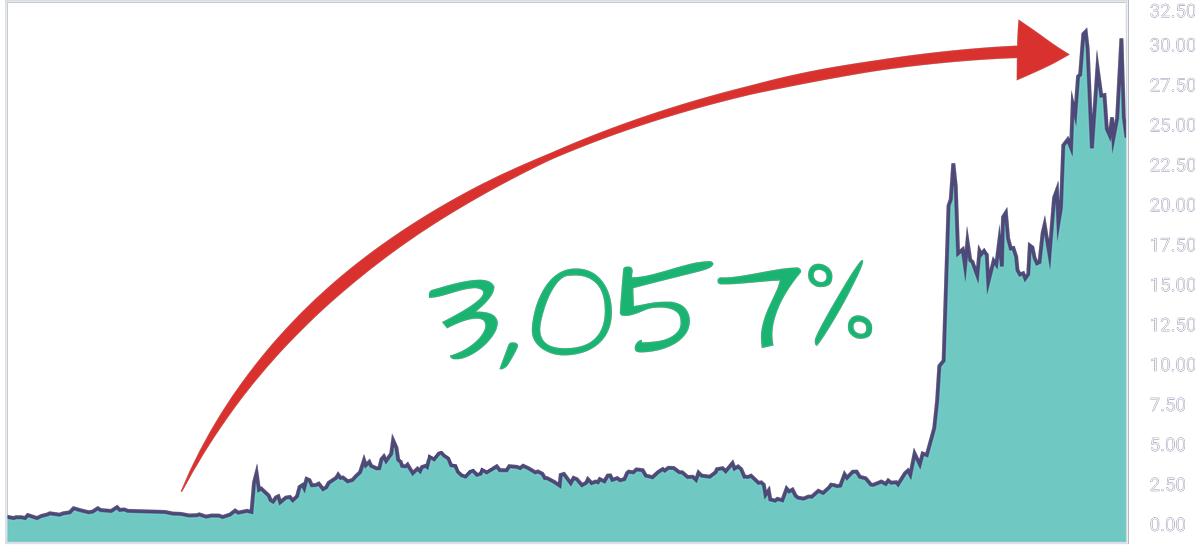

Opportunities like I recently found on Fulcrum Therapeutics, they are working on a treatment for a special kind of Muscular Dystrophy and fell from $15 to just $8 after missing their primary endpoint on the drug they were working on.

It's never a good idea to buy a stock that is in a nose dive immediately after bad news.

Unless you’ve got inside information.

1 week after the bad news we saw the Chief Medical Officer, VP of finance, the Senior Vice President and the Managing director all buy stock on the same day.

If that were not enough. Three of those buys were first time buys.

It was clear they knew something.

So on Jul 13 we issued a buy alert to our members and 13 days later the stock was up over 290% in profit!

Our users were able to scoop up 290% **on the stock** in less than 2 weeks.

“How to filter that information to find 1,000%+ Winners”

And Michael, it can be a lot of work. Which is of course why you should just let me do it for you.

But for those who want to dig deeper here is the short version.

I start by filtering out all the noise.

Things like institutional purchases or trust activity...

Option Exercises, most of those are just executives cashing in on options given to them by their company...

Scheduled buys, you probably have this where you work.

Every time you get paid you can choose to take some of your check and automatically buy some stock.

It doesn't really mean anything so we can throw that out as well.

I also discard any small purchases. If it doesn't show conviction I don't care about it.

These filters alone leave me with a much smaller list of transactions to look over.

And then it's just a matter of applying some basic filters to find the best opportunities.

Opportunities like I recently found on Fulcrum Therapeutics, they are working on a treatment for a special kind of Muscular Dystrophy and fell from $15 to just $8 after missing their primary endpoint on the drug they were working on.

It's never a good idea to buy a stock that is in a nose dive immediately after bad news.

Unless you’ve got inside information.

1 week after the bad news we saw the Chief Medical Officer, VP of finance, the Senior Vice President and the Managing director all buy stock on the same day.

If that were not enough. Three of those buys were first time buys.

It was clear they knew something.

So on Jul 13 we issued a buy alert to our members and 13 days later the stock was up over 290% in profit!

Our users were able to scoop up 290% **on the stock** in less than 2 weeks.

michael

You mentioned that finding these kinds of trades comes down to a few basic filters?

five components for super charging your investing

Steven

Absolutely, and I have a very easy process for doing that. I put every opportunity into one of 5 buckets.

#1 Conviction buys

#2 First Time Buys

#3 Extreme Buys

#4 Cluster Buys

#5 Perfect Track Record Insiders

#1 Conviction buys

#2 First Time Buys

#3 Extreme Buys

#4 Cluster Buys

#5 Perfect Track Record Insiders

michael

Steven, can you walk us through each one of these?

Steven

Sure, let's look at conviction buys first. It kind of reminds me of the parable of the hidden treasure.

It says... there was some treasure hidden in a field, which a man found and covered up. Then in his joy he goes and sells all that he has and buys that field.

Why was he willing to risk so much and joyfully at that?

Because he knew the value of what he had found.

When I see an Insider drop a year or two's salary into the stock. That says a lot.

Take Charles Roland, Charles is a director on the board of Viking Therapeutics.

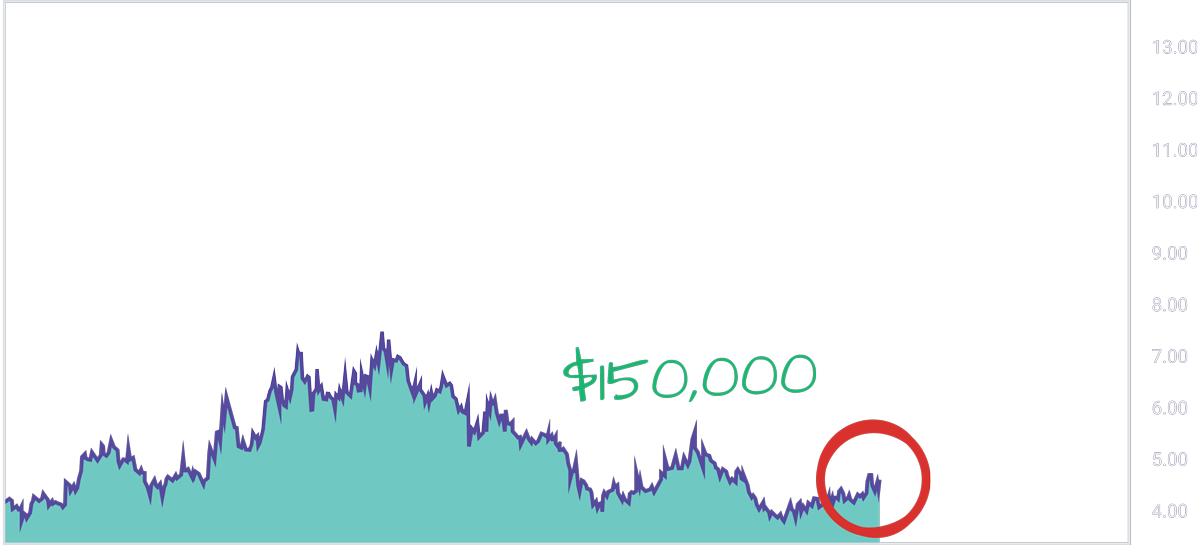

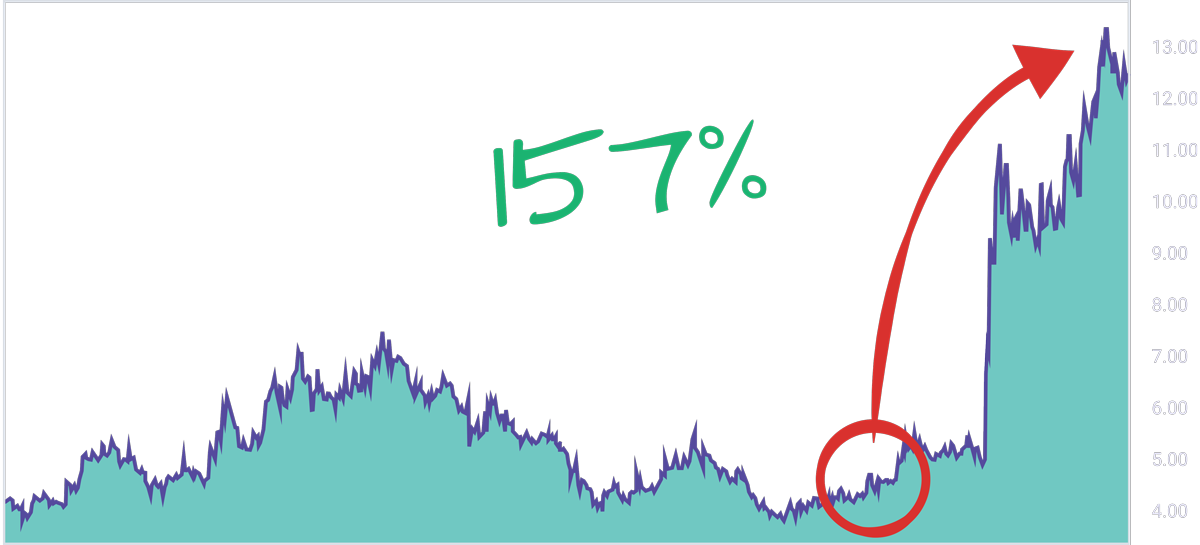

On May 29th he dropped $150k dollars into the company’s stock.

It says... there was some treasure hidden in a field, which a man found and covered up. Then in his joy he goes and sells all that he has and buys that field.

Why was he willing to risk so much and joyfully at that?

Because he knew the value of what he had found.

When I see an Insider drop a year or two's salary into the stock. That says a lot.

Take Charles Roland, Charles is a director on the board of Viking Therapeutics.

On May 29th he dropped $150k dollars into the company’s stock.

Just two days later this hit the wire...

And the stock jumped 157%!

Any chance our boy Charles knew about this announcement?

Of course he did! He sits on the board of directors.

But these Insiders can’t hide from us anymore.

michael

Ok, so how about First time buyers. Why is that significant

Steven

Now keep in mind, no matter the situation I want the buy to show conviction.

But if it’s also the first time they have bought their stock that says something.

You have to realize I am not talking about someone new to the company.

This would be someone who has worked there for a long time but for some reason hasn't bought the stock.

Then out of the blue they go in with conviction.

Take Richard Levy,

Richard is on the Board of directors for a pharmaceutical company named Madrigal Pharmaceuticals.

After sitting on the board of directors for more than a year without buying a single stock.

He picked up over 9,000 shares in just 3 days.

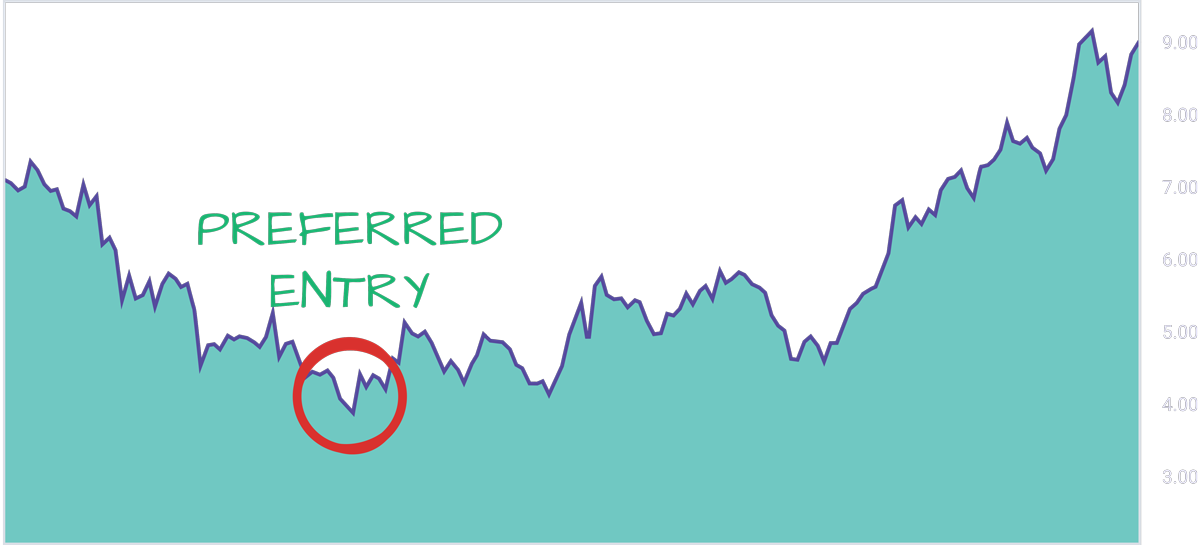

Take a look at this chart. Is there anything here that signals to you its time to buy?

I mean It’s been flat for almost a year.

But if it’s also the first time they have bought their stock that says something.

You have to realize I am not talking about someone new to the company.

This would be someone who has worked there for a long time but for some reason hasn't bought the stock.

Then out of the blue they go in with conviction.

Take Richard Levy,

Richard is on the Board of directors for a pharmaceutical company named Madrigal Pharmaceuticals.

After sitting on the board of directors for more than a year without buying a single stock.

He picked up over 9,000 shares in just 3 days.

Take a look at this chart. Is there anything here that signals to you its time to buy?

I mean It’s been flat for almost a year.

Four weeks later they announced positive drug trials.

and the stock went for a 900% run

I'm just going to keep saying it....

Following insiders using our Insiders Exposed method is the only way to get into pre-breakout stocks before they make these massive moves higher.

michael

Clearly that was not a coincidence. This makes total sense. But how about these “extreme” buys?

What is that all about?

What is that all about?

Steven

Michael, let me ask you a question.

Where would you like to buy this stock?

Where would you like to buy this stock?

michael

Obviously at the low.

Steven

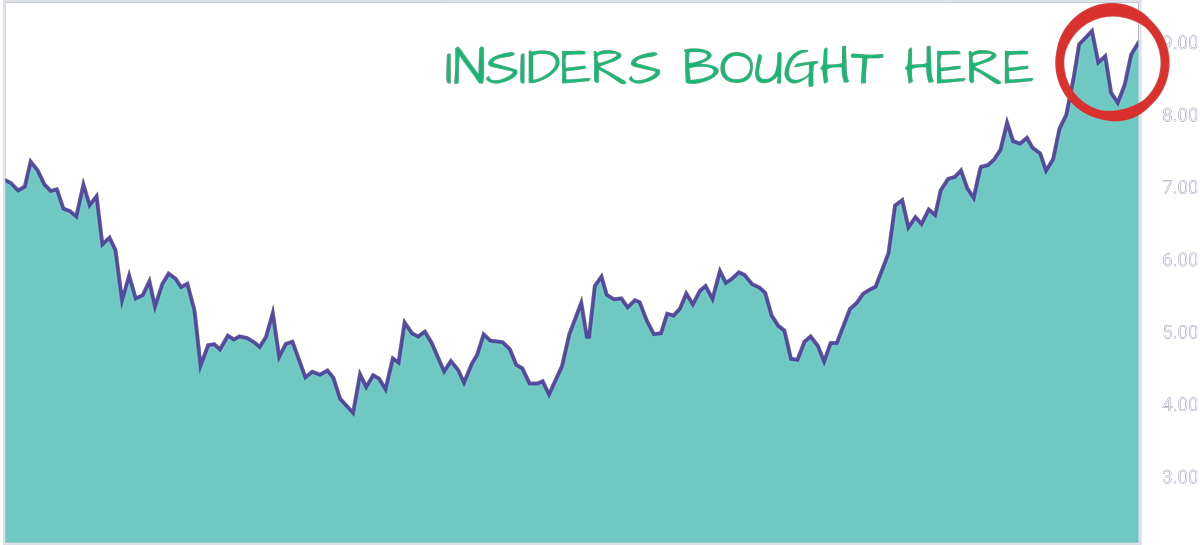

Me too, it's scary buying at the highs.

It's one thing buying with the trend, it's another thing altogether buying at the top of a trend.

Nobody wants to be “that guy” who buys the top of the market!

You have to remember that these Insiders are no different than us.

And if they are not willing to wait for a even a slight pull back, that means there is something coming and they don't want to risk missing it.

On March 5th, the Vice President, CFO and Chief Executive Officer for this company all bought on the same day.

It's one thing buying with the trend, it's another thing altogether buying at the top of a trend.

Nobody wants to be “that guy” who buys the top of the market!

You have to remember that these Insiders are no different than us.

And if they are not willing to wait for a even a slight pull back, that means there is something coming and they don't want to risk missing it.

On March 5th, the Vice President, CFO and Chief Executive Officer for this company all bought on the same day.

Then this happened...

The stock has moved a whopping 2188%!

Some things just make sense, and following insiders makes sense.

How much stock would you have bought at just $9 a share.

Seriously, I want you to think about how much you would be willing to put into this trade.

Now 20x that number. That is how much you could have made just by following these traders who are in the know.

michael

Man that is amazing.

Your talking about turning 5k into $1.1 million dollars!

I got to hear more. Tell me about these cluster buys.

Your talking about turning 5k into $1.1 million dollars!

I got to hear more. Tell me about these cluster buys.

Steven

Sure, cluster buys happen when multiple insiders buy in close proximity. In fact, Enphase Energy was a cluster buy.

the Vice President, CFO and Chief Executive Officer all bought this stock on the same day.

This is one of my favorite signals and we see it quite often.

Remember buying stock is far more risky when you don’t have inside information.

So when you have multiple people within Inside information all willing to risk significant amounts of their own money on a trade. It sends a very strong signal.

Take Resolute Energy for example

Insiders absolutely went nuts for this stock.

We saw 12 insiders buy in just two weeks.

At the time this was an under the radar micro cap.

Within a year the stock went parabolic, jumping over 1000%.

the Vice President, CFO and Chief Executive Officer all bought this stock on the same day.

This is one of my favorite signals and we see it quite often.

Remember buying stock is far more risky when you don’t have inside information.

So when you have multiple people within Inside information all willing to risk significant amounts of their own money on a trade. It sends a very strong signal.

Take Resolute Energy for example

Insiders absolutely went nuts for this stock.

We saw 12 insiders buy in just two weeks.

At the time this was an under the radar micro cap.

Within a year the stock went parabolic, jumping over 1000%.

And the Insiders were the only sign that would have gotten you into this trade prior to the move.

michael

Ok, so...

#1 are Conviction Buys

#2 are First Time Buys

#3 are Extreme Buys

#4 are Cluster Buys

Now tell us about these perfect track record traders.

Is it what it sounds like?

#1 are Conviction Buys

#2 are First Time Buys

#3 are Extreme Buys

#4 are Cluster Buys

Now tell us about these perfect track record traders.

Is it what it sounds like?

Steven

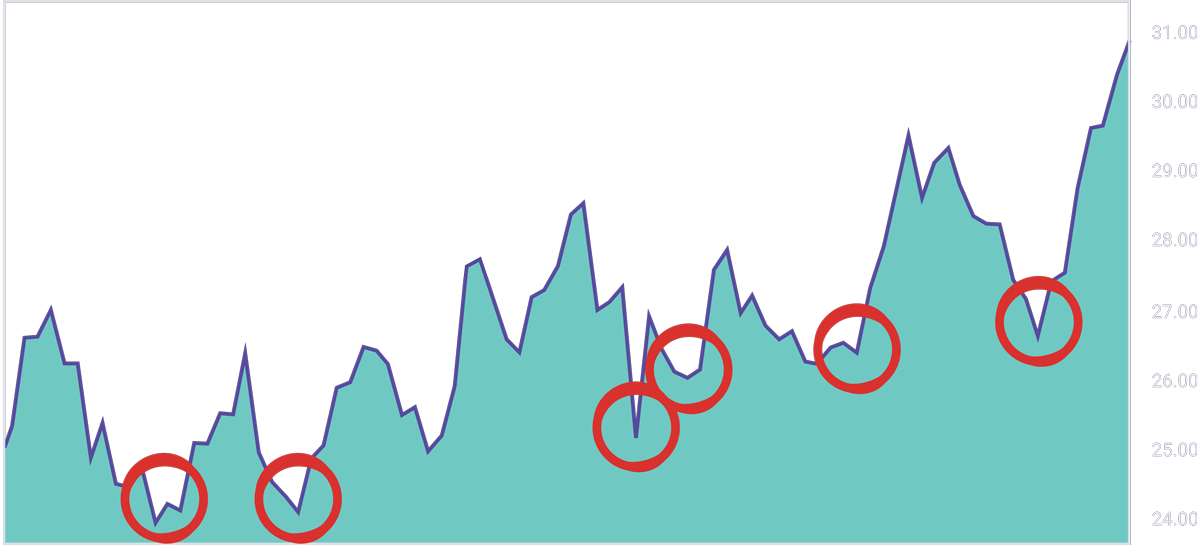

Yes it is MICHAEL. This all about Insiders who regularly buy their stocks at the lows.

Insiders like Lisa Oneil.

Lisa is the CFO of a regional bank concentrated in northern Indiana. Over a 2 year period Lisa bought her stock 6 times.

She timed every buy perfectly.

Insiders like Lisa Oneil.

Lisa is the CFO of a regional bank concentrated in northern Indiana. Over a 2 year period Lisa bought her stock 6 times.

She timed every buy perfectly.

I don't know if you have ever tried picking bottoms but it's not easy.

Let alone doing it 6 times on the same stock.

But you have to remember these people know things about their stock that you and I don’t know.

I hope you are beginning to see that using the Insiders Exposed method is the only way to get into these pre-breakout stocks before they make massive moves higher.

michael

Steven, I love how straightforward this is, and that you have been able to automate a lot of the segmenting and filtering process.

There really are a ton of these trades every day and it would be impossible to go through them all one by one. So kudos for figuring all that out.

But let me ask you a question. Are there certain market conditions this works better in or can you use it pretty much anytime.

There really are a ton of these trades every day and it would be impossible to go through them all one by one. So kudos for figuring all that out.

But let me ask you a question. Are there certain market conditions this works better in or can you use it pretty much anytime.

the current market is perfect for this type of investing

Steven

The answer is both.

Let me explain...

There are times when overall insider activity is much higher.

This is normally when the market is pulling back as a whole.

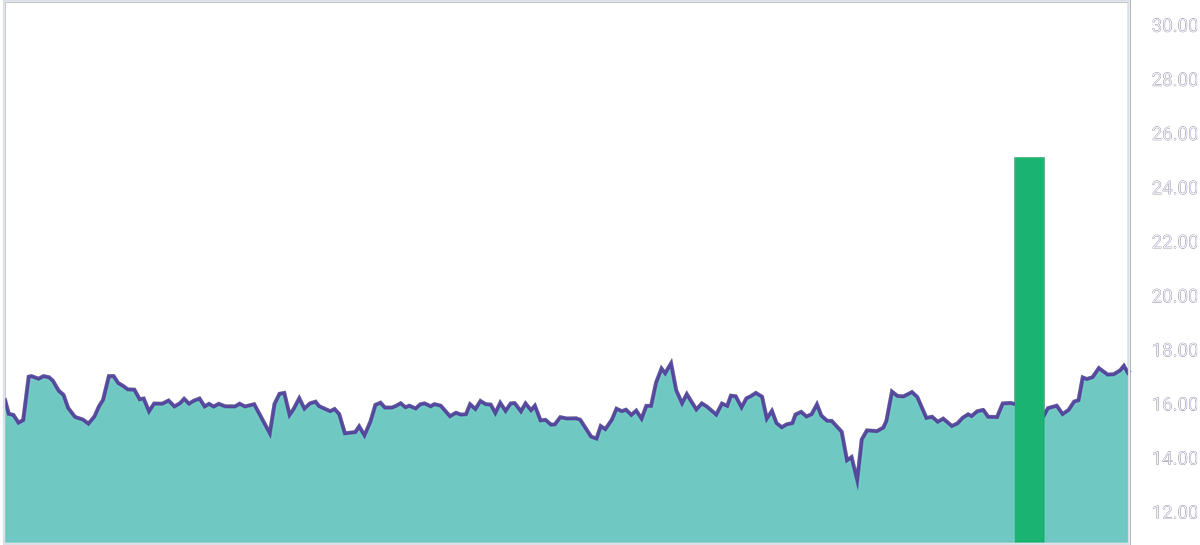

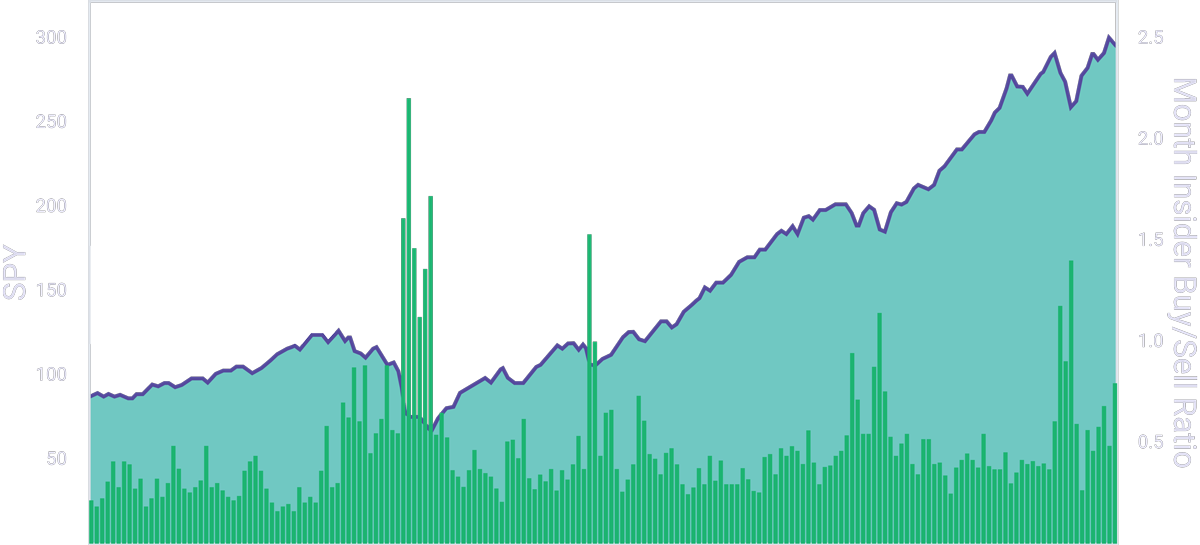

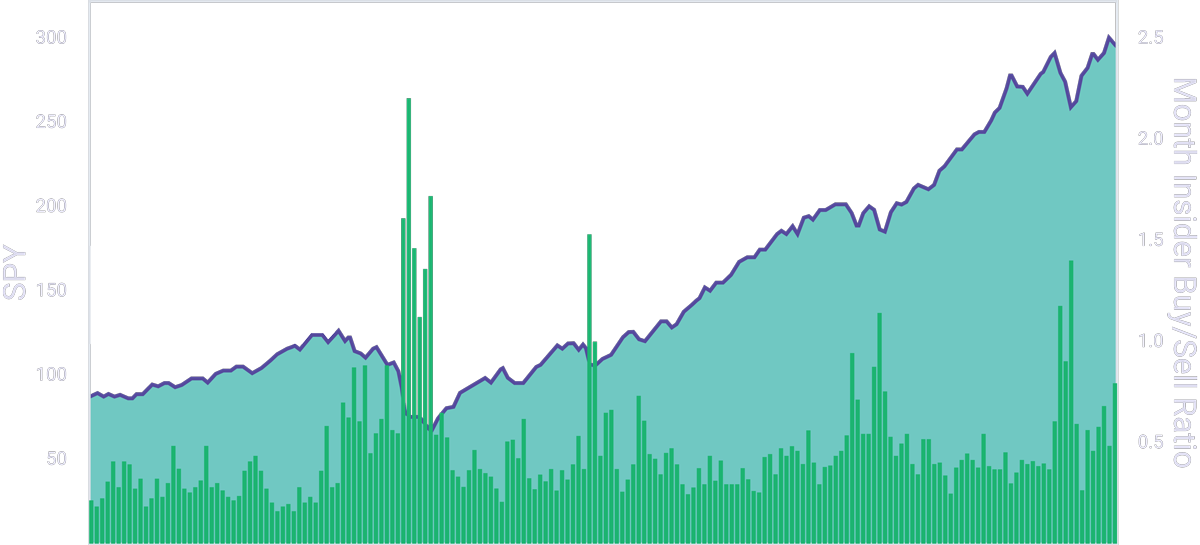

Take a look at this chart.

This is the S&P 500 and it shows the buy/sell ratio for Insider buying across every market sector. It represents the broader market as a whole.

Let me explain...

There are times when overall insider activity is much higher.

This is normally when the market is pulling back as a whole.

Take a look at this chart.

This is the S&P 500 and it shows the buy/sell ratio for Insider buying across every market sector. It represents the broader market as a whole.

The blue line represents price and the green bars represent insider buying.

You’ll notice that every time we see a big sell off, insiders start buying in size.

So it's a great indicator for when the market is going to turn.

Just look at what happened during the coronavirus sell off.

A record number of people exited the market right at the lows saying goodbye to billions of dollars in wealth.

Meanwhile, insiders were buying in record numbers!

Would you like to have had this information?

Now you can.

And the other side of this is you will notice that there is ALWAYS insider buying happening.

That’s because companies are always coming out with new drugs, or acquiring new businesses and creating massive opportunities for you and me to capture huge gains.

So no matter what the market condition is there are always opportunities like...

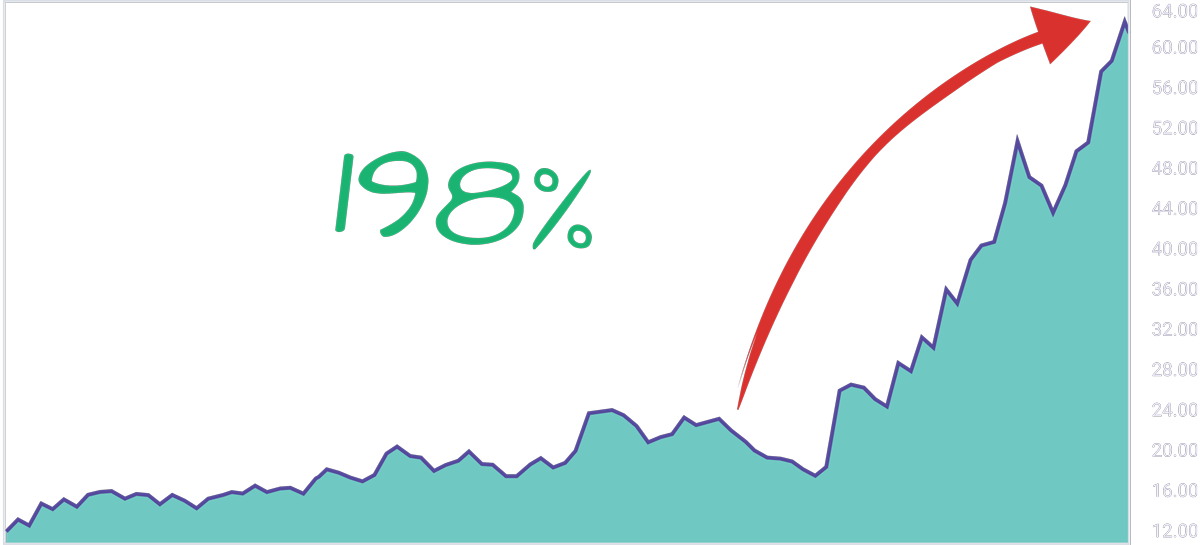

Vicor Corporation where insiders signaled a 198% move...

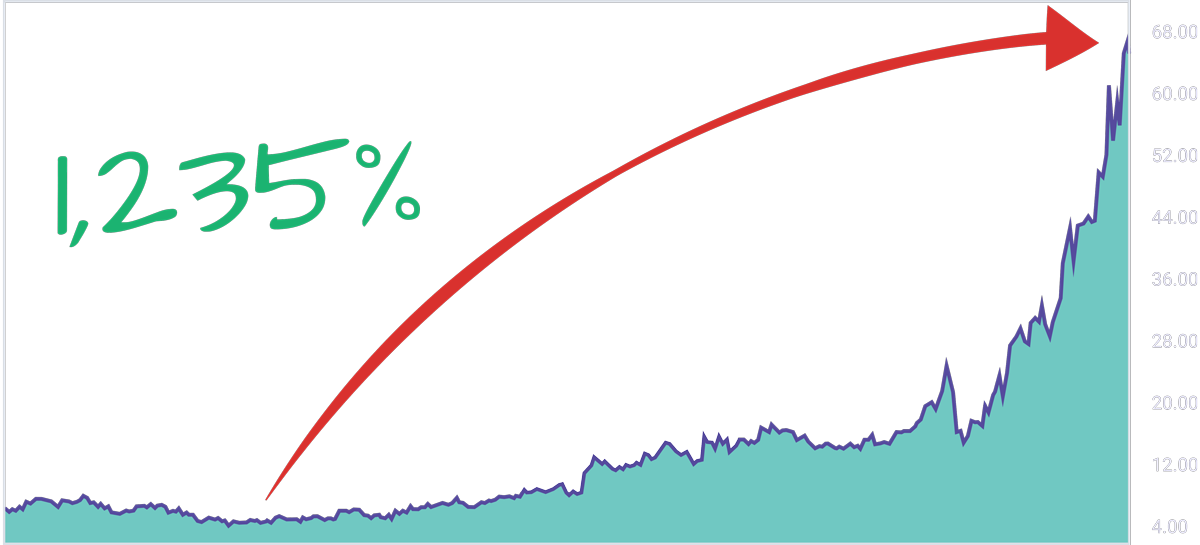

Ameresco Inc where we saw a 1,235% move...

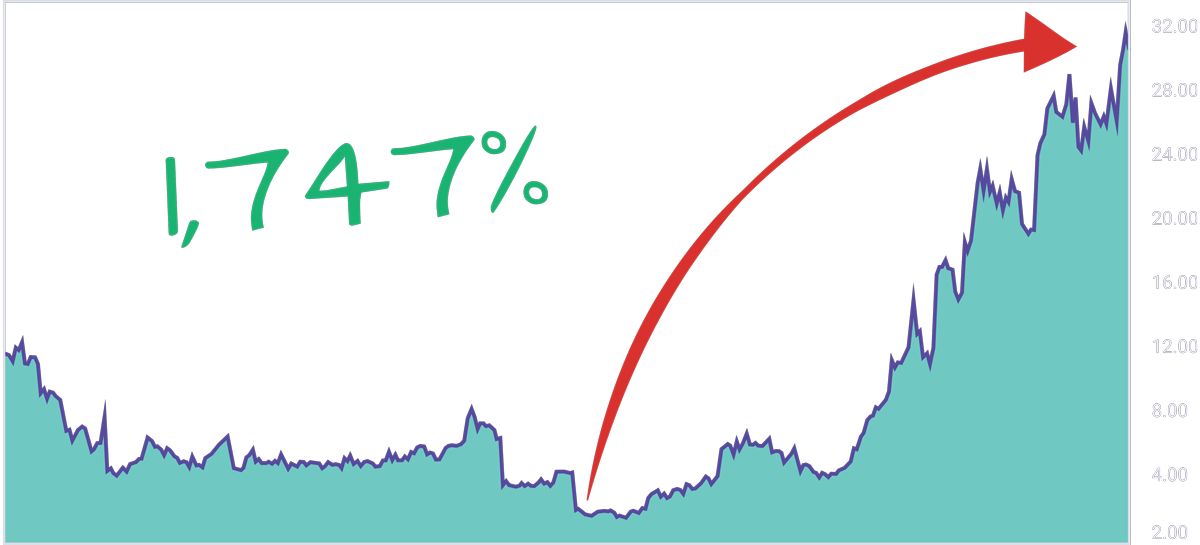

And an incredible 1,747% on EXEL...

All stock gains.

All from following insiders

michael

So as simple as that sounds it still seems like a lot of work.

How is someone who works full time supposed to do this?

How is someone who works full time supposed to do this?

Steven

The easy way is to join our Insiders Exposed family and let me do all the work.

I have been saying from the get go that my goal is to prove to our audience that the best way to consistently buy pre-breakout stocks is to follow these insiders.

And that joining my “Insiders Exposed” alert service is the only way to follow the right insiders with almost no time commitment.

In fact, in the next section I’m going to share the details of three stocks with massive insider buying that new members can get into right now.

As well as how to keep getting opportunities like these sent directly to your inbox every month.

I call this section

3 Stocks With Massive Insider Buying In Them Right Now, and how to own them

I have been saying from the get go that my goal is to prove to our audience that the best way to consistently buy pre-breakout stocks is to follow these insiders.

And that joining my “Insiders Exposed” alert service is the only way to follow the right insiders with almost no time commitment.

In fact, in the next section I’m going to share the details of three stocks with massive insider buying that new members can get into right now.

As well as how to keep getting opportunities like these sent directly to your inbox every month.

I call this section

3 Stocks With Massive Insider Buying In Them Right Now, and how to own them

3 Stocks With Massive Insider Buying In Them Right Now

michael

This is the part I am excited for, I just don’t see any other way to get into these big moves consistently before they happen outside of following these insiders.

And honestly, I would just prefer you do the work, SO why don’t you share the fruit of your labor with us today.

Tell us about these 3 trades

And honestly, I would just prefer you do the work, SO why don’t you share the fruit of your labor with us today.

Tell us about these 3 trades

Steven

Investment Opportunity #1

Sure, the first is a small biotech company on the edge of a turnaround.

An activist fund recently brought on a new CEO, and insiders immediately started throwing a ton of cash into the stock.

In fact, we saw five separate insiders purchase the stock at the same time.

This checks a number of boxes, we have a cluster buy, buys with conviction, and a first time buyer.

Combine that with a handful of treatments entering the end stage in their development pipeline... and it makes for a very compelling story.

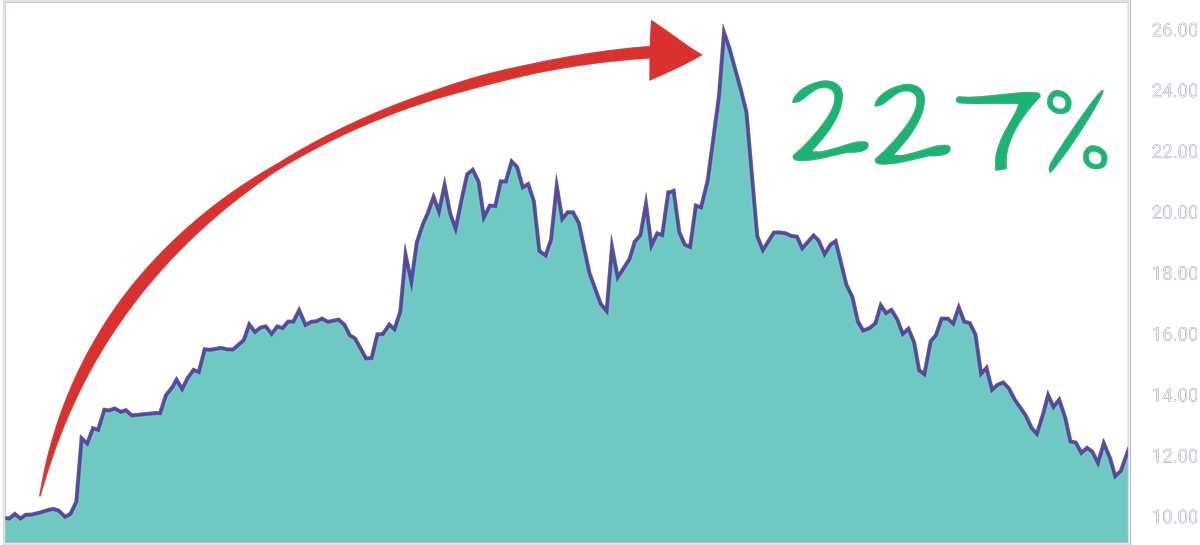

We have seen this time and time again with these small biotech firms, they have been some of our biggest winners and this one could easily see a 227% profit if my first target is met.

An activist fund recently brought on a new CEO, and insiders immediately started throwing a ton of cash into the stock.

In fact, we saw five separate insiders purchase the stock at the same time.

This checks a number of boxes, we have a cluster buy, buys with conviction, and a first time buyer.

Combine that with a handful of treatments entering the end stage in their development pipeline... and it makes for a very compelling story.

We have seen this time and time again with these small biotech firms, they have been some of our biggest winners and this one could easily see a 227% profit if my first target is met.

Investment Opportunity #2

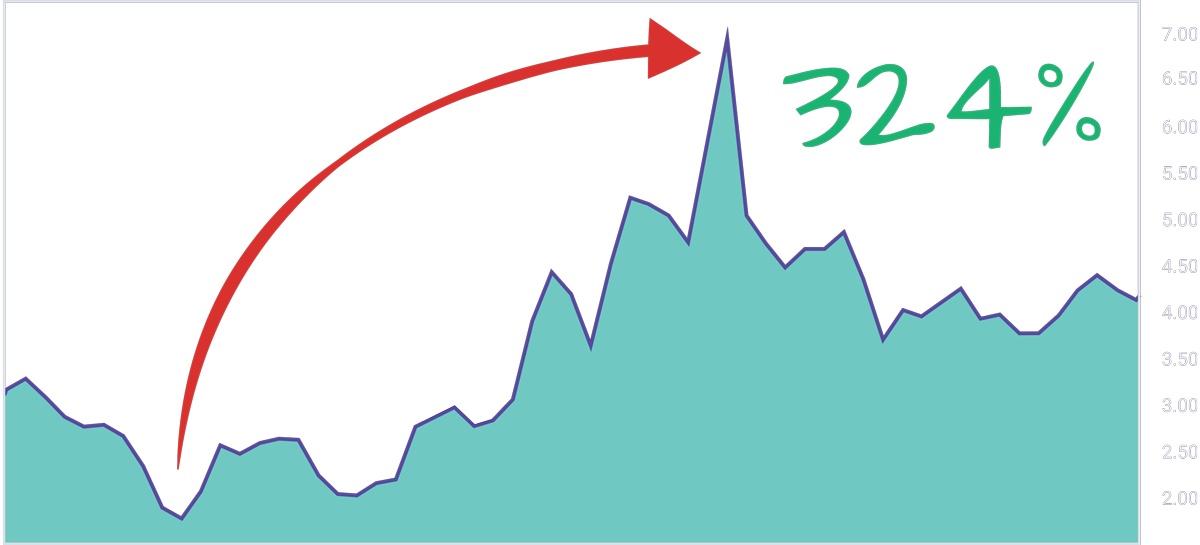

My second pick is a small regional retail company that just acquired another brand.

It’s rare to see Insiders buying at market price right after a merger.

This kind of behavior typically happens prior. And it's kind of like buying at the extremes.

So when I saw the CEO drop $972 thousand dollars of his own money into the stock at Market Prices.

I knew something was up.

This is a trade with conviction and If my target is met we could see an easy 324% on this one.

It’s rare to see Insiders buying at market price right after a merger.

This kind of behavior typically happens prior. And it's kind of like buying at the extremes.

So when I saw the CEO drop $972 thousand dollars of his own money into the stock at Market Prices.

I knew something was up.

This is a trade with conviction and If my target is met we could see an easy 324% on this one.

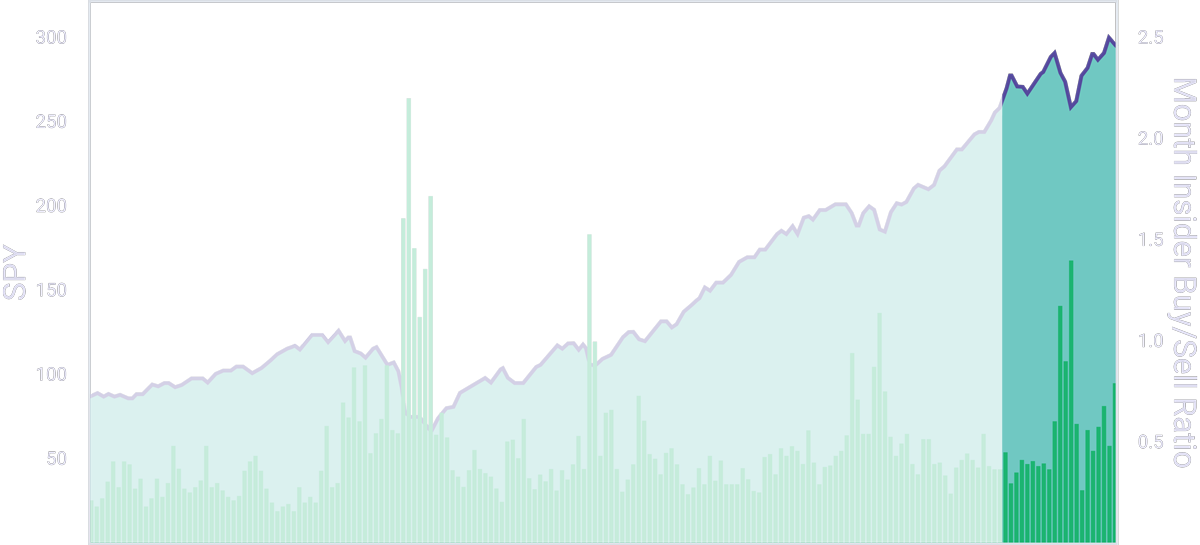

investment Opportunity #3

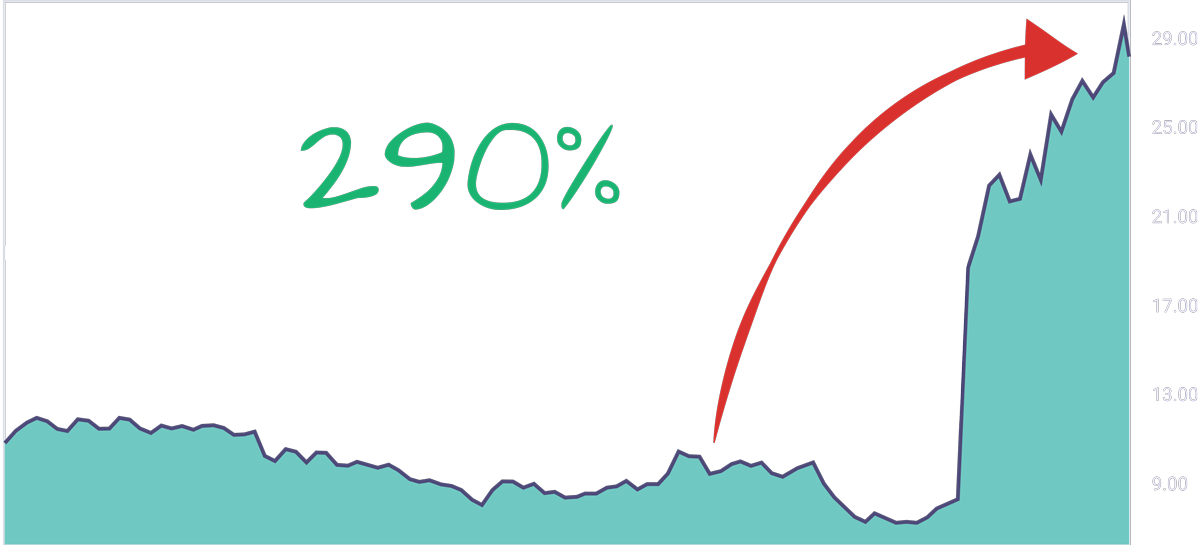

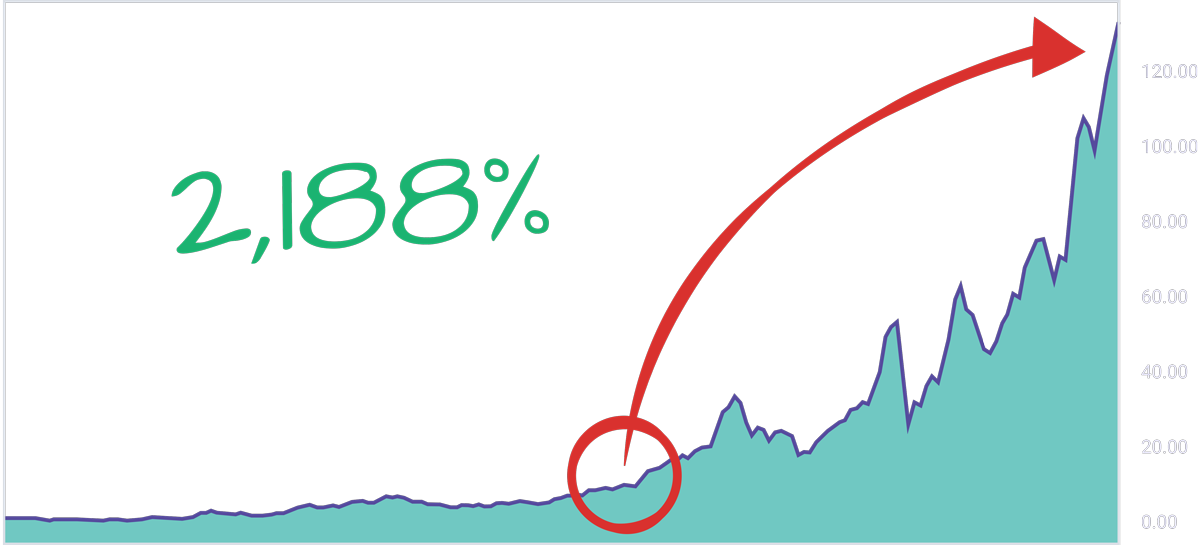

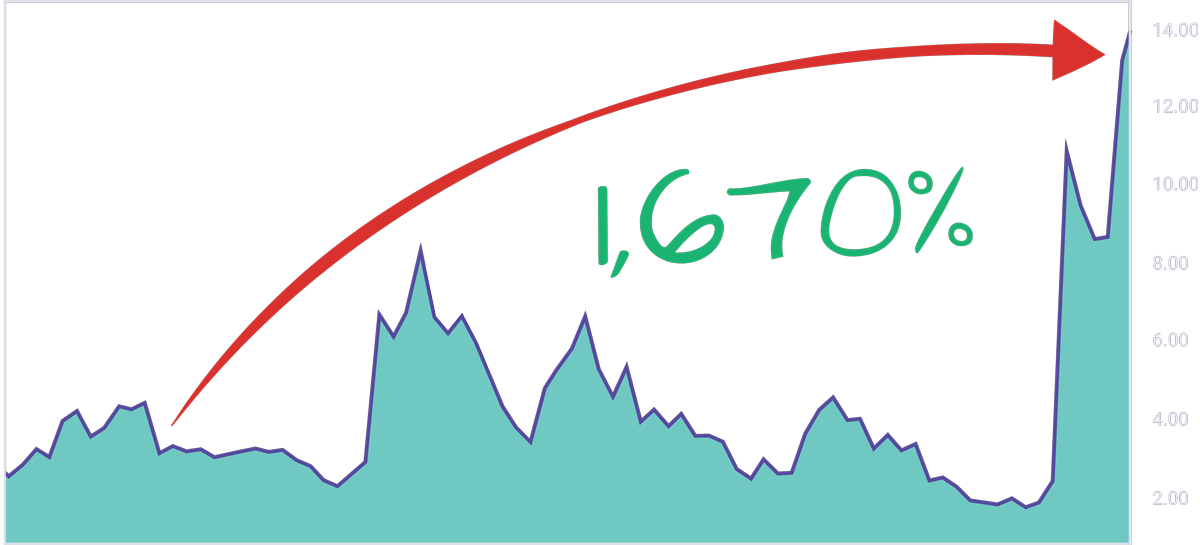

My 3rd pick is very exciting.

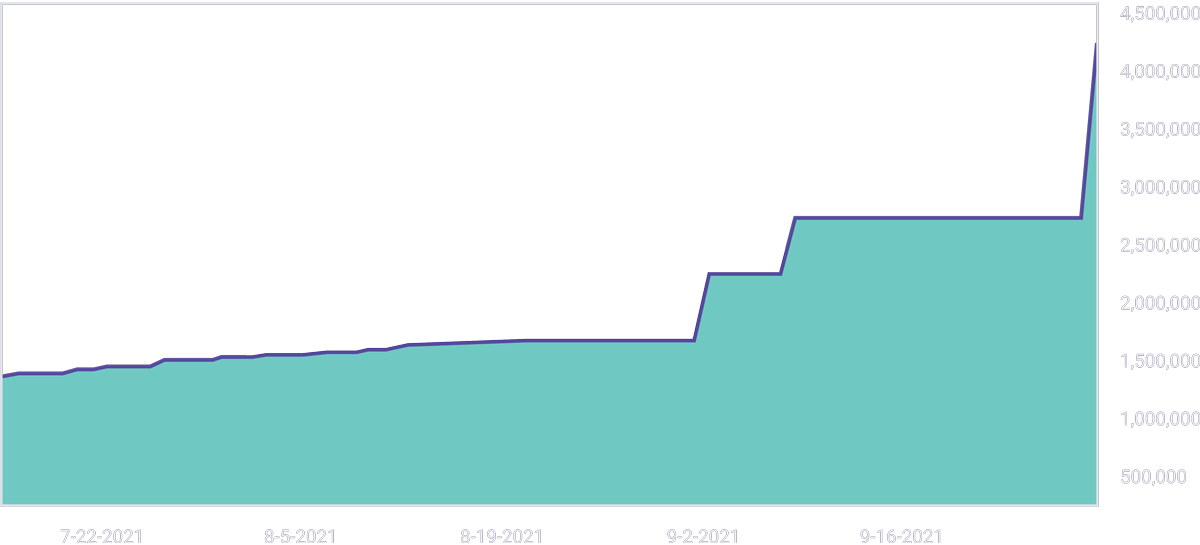

Take a look at this chart.

Take a look at this chart.

It outlines shares owned by the founder of a holding conglomerate that acquires tech companies and patents surrounding disruptive technologies with MASSIVE upside.

For years he has held a good number of shares in this company but a few months ago…

Out of nowhere he starts piling in.

In fact, he more than doubled his shares at a personal cost of over 6 million dollars.

This is a buy with extreme conviction.

Have you ever heard the saying “He bet the farm on it”?

This guy is all in!

One of the company's recent investments is likely getting ready to pay off, and he knows it!

For months the stock has been range bound but as we have seen again and again once the public finds out whatever our founder knows, that will all change.

Even a retest of the highs makes this an easy triple. And with options we could see as much as 1,670%!

michael

That is incredible!

So Steven, I know you have put together a special offering for those on the webinar today who want to get their hands on these three stocks.

Do you mind telling us about it?

So Steven, I know you have put together a special offering for those on the webinar today who want to get their hands on these three stocks.

Do you mind telling us about it?

steven

Sure Michael but first I want to make sure we are all on the same page.

Does everyone understand how massive of an advantage it is to know what these insiders are doing?

Can you see how by just following my lead, and ethically stealing their trades you can make a significant amount of money?

Do you think you could be successful with this?

With that said, do I have your permission to share my offer to you. I hate to make assumptions.

Does everyone understand how massive of an advantage it is to know what these insiders are doing?

Can you see how by just following my lead, and ethically stealing their trades you can make a significant amount of money?

Do you think you could be successful with this?

With that said, do I have your permission to share my offer to you. I hate to make assumptions.

michael

Alright guys, do you mind if Steven takes a few minutes to explain what he has in store for us?...

Jeff wants to know, Christi wants to know, Manesh wants know.

I could go on but Steven but it looks like that is a resounding yes!

Jeff wants to know, Christi wants to know, Manesh wants know.

I could go on but Steven but it looks like that is a resounding yes!

“Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits"

Steven

Ok, great!

I have just put the finishing touches on a special report that all new members can get their hands on today.

I am calling it “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits".

In it I provide the ticker symbols and all my research on the three stocks I just shared.

I also provide very simple instructions for buying the stock.

I give you a clear entry price along with a call option enabling you to potentially make 4 or 5 times what you could make on the stock with a fraction of the risk.

But… You will need to be decisive.

We don’t know what the Insiders know.

Once it's made public the stock will react and if you don't own shares it will be too late.

I have just put the finishing touches on a special report that all new members can get their hands on today.

I am calling it “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits".

In it I provide the ticker symbols and all my research on the three stocks I just shared.

I also provide very simple instructions for buying the stock.

I give you a clear entry price along with a call option enabling you to potentially make 4 or 5 times what you could make on the stock with a fraction of the risk.

But… You will need to be decisive.

We don’t know what the Insiders know.

Once it's made public the stock will react and if you don't own shares it will be too late.

michael

Have you ever put out a report like this before?

steven

"past reports are responsible for multiple triple digit gains"

Yes Michael, we have put several of these reports out over the years and here is just a sampling of how some of our picks did.

AGYS moved 271%

Stitch Fix moved 318%

Advansix moved 261%

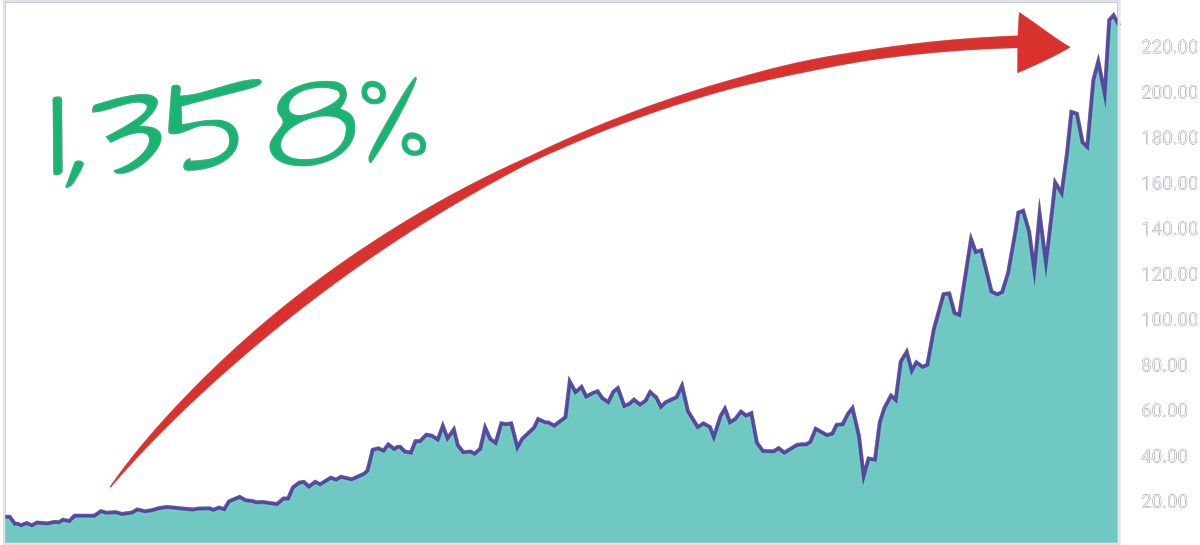

Cardalytics moved 373%

WMS moved 261%

And ETSY which has moved a whopping 1,358%.

All stock moves (meaning those are not options profit) and all after we published a special report like the one we are giving new members today

AGYS moved 271%

Stitch Fix moved 318%

Advansix moved 261%

Cardalytics moved 373%

WMS moved 261%

And ETSY which has moved a whopping 1,358%.

All stock moves (meaning those are not options profit) and all after we published a special report like the one we are giving new members today

michael

Now Steve, regarding the three you are looking at now, you said if your targets are met we could see 227% on the first one, 324% on the second one, and that with options potentially 1,670% on the third.

Did I get that right?

Did I get that right?

steven

That's correct Michael...

"In fact, just $500 dollars in each of those trades has the potential to make a person $11,105 in profit!"

So as you can see that report alone has a real world value of $11,105 and anyone who becomes part of the Insiders Exposed Family today will get this report absolutely free.

This is the best way I know to get new members off and running from day 1.

This is the best way I know to get new members off and running from day 1.

michael

That's awesome Steven. But when you say “when someone joins your service”, what exactly are you talking about.

Steven

Great question, Let’s talk about the core of our service.

Each month my team and I will spend hundreds of hours combing through all the insider trades looking for those needle in a haystack opportunities.

The ones that have the potential to move 200, 500, heck even 1,000 percent.

Then I’ll blast out a complete write up on the stock explaining why we like it along with clear instructions on what to do.

I keep the actionable information very simple.

It looks like this.

Buy VPG at the market. Put a stop at $32.

For those who want the option that is available as well.

If you would like you can also opt in to these alerts to get notified by text.

Each month my team and I will spend hundreds of hours combing through all the insider trades looking for those needle in a haystack opportunities.

The ones that have the potential to move 200, 500, heck even 1,000 percent.

Then I’ll blast out a complete write up on the stock explaining why we like it along with clear instructions on what to do.

I keep the actionable information very simple.

It looks like this.

Buy VPG at the market. Put a stop at $32.

For those who want the option that is available as well.

If you would like you can also opt in to these alerts to get notified by text.

michael

That makes it super convenient in case I am out to dinner or something.

steven

Actually Michael, I would hate to interrupt your dinner.

Family time is very important to me and you have to remember that these guys have a long term outlook so it's not the end of the world if you don't get in immediately.

Even with the options I am typically looking at a 6 month expiration.

That's one of the best parts about this methodology, you don't have to be chained to your computer.

In fact, I also send out a weekly summary with a quick review of any new trades or any adjustments to existing trades.

Some traders will just look at this once a week.

Of course sometimes the stock we’re trading has moved up a little bit, but I would say equally it has moved down a little.

Bottom line, don’t feel stressed to get into a trade right away.

You don’t need that stress and it's not necessary.

Family time is very important to me and you have to remember that these guys have a long term outlook so it's not the end of the world if you don't get in immediately.

Even with the options I am typically looking at a 6 month expiration.

That's one of the best parts about this methodology, you don't have to be chained to your computer.

In fact, I also send out a weekly summary with a quick review of any new trades or any adjustments to existing trades.

Some traders will just look at this once a week.

Of course sometimes the stock we’re trading has moved up a little bit, but I would say equally it has moved down a little.

Bottom line, don’t feel stressed to get into a trade right away.

You don’t need that stress and it's not necessary.

michael

What a relief!

So often services like this require almost immediate response time or you pretty much miss the boat.

So often services like this require almost immediate response time or you pretty much miss the boat.

steven

That is true but this is not day trading.

We have a more medium term outlook with our trades averaging around 3 months.

Every once in a while we will be in and out of a stock in a few days or week, but it’s not the norm.

We have a more medium term outlook with our trades averaging around 3 months.

Every once in a while we will be in and out of a stock in a few days or week, but it’s not the norm.

michael

I am glad you mentioned that. So what's the longest time you will hold trades?

steven

As long as they keep going up! In fact, we have some in our portfolio right now that have been going for years and are almost up 1,000%.

michael

How many trades should we expect to get each month?

steven

We typically see between 2-5 investment opportunities a month that meet our criteria.

As I said this is not a day trading service.

So if you're looking for a constant stream of trades this may not be for you.

As I said this is not a day trading service.

So if you're looking for a constant stream of trades this may not be for you.

michael

I know you work with a lot of institutional clients but what do you charge for this monthly research package?

steven

I designed this package for the retail investor so rather than my typical 10k monthly retainer that I charge institutions,

regular investors can access this service for just $5,000 a year and can potentially make that back in a couple of trades.

In fact, my hope is that the trades in my premium report would more than cover the cost of everything you get today many times over.

And it would not be the first time new members would make back their investment on their very first trade.

regular investors can access this service for just $5,000 a year and can potentially make that back in a couple of trades.

In fact, my hope is that the trades in my premium report would more than cover the cost of everything you get today many times over.

And it would not be the first time new members would make back their investment on their very first trade.

michael

Wow, I love the fact that we have the potential to make our entire investment back almost right away.

But wait a minute, what if I have never traded before.

But wait a minute, what if I have never traded before.

this is the best way for someone new to investing to get started

Steven

Michael, I want to make sure that anyone can benefit from these insiders.

The #1 reason why people don’t succeed is a lack of getting started.

They are overwhelmed and that doesn’t need to be the case with this.

I am going to hand feed you the trades but I am also going to include a very special training program I put together that will walk you through everything from opening a trading account to entering your first trade and properly managing and exiting.

It's all very easy, in fact you can even do it from your phone. So if you can send SMS messages you can do this.

The course normally sells for $997 but I am going to include it today at no charge.

So no matter how little you know about trading you can do this.

In fact, I got an email the other day from someone from one of our memebers who told me he was brand new to investing when he signed up, and he made over $2,000 on his first trade.

You know what…

He sat in a seat very much like you are now, watching a webinar similar to this one.

He probably had some of the same concerns you have.

But he took a chance and was glad he did.

So don’t let those concerns keep you from getting started.

Just to recap…

you get my special report “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits" this outlines the three stocks I covered earlier with massive insider buying right now.

And if my targets are hit we could see $11,105 in profit

You also get access to my core service for a full year. And that will get you 2-5 new investment opportunities every month. That has a value of $4,995

And to make sure no one is left behind you also get my beginners course which has a $997 value.

That brings the total value to $17,097

The #1 reason why people don’t succeed is a lack of getting started.

They are overwhelmed and that doesn’t need to be the case with this.

I am going to hand feed you the trades but I am also going to include a very special training program I put together that will walk you through everything from opening a trading account to entering your first trade and properly managing and exiting.

It's all very easy, in fact you can even do it from your phone. So if you can send SMS messages you can do this.

The course normally sells for $997 but I am going to include it today at no charge.

So no matter how little you know about trading you can do this.

In fact, I got an email the other day from someone from one of our memebers who told me he was brand new to investing when he signed up, and he made over $2,000 on his first trade.

You know what…

He sat in a seat very much like you are now, watching a webinar similar to this one.

He probably had some of the same concerns you have.

But he took a chance and was glad he did.

So don’t let those concerns keep you from getting started.

Just to recap…

you get my special report “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits" this outlines the three stocks I covered earlier with massive insider buying right now.

And if my targets are hit we could see $11,105 in profit

You also get access to my core service for a full year. And that will get you 2-5 new investment opportunities every month. That has a value of $4,995

And to make sure no one is left behind you also get my beginners course which has a $997 value.

That brings the total value to $17,097

michael

That sounds great Steve. But what if someone has a question or needs help with something.

Steven

Anytime someone joins our family they can contact us via email anytime

and we will reply within 24 hours. We have a fantastic support team.

We also offer platinum level support which we charge $997 a year for.

This enables you to call in and talk directly with our concierge team on the phone.

This is rare in our industry but there is nothing worse than having a trade issue and not being able to contact someone right away.

When you have money on the line you want answers now not tomorrow.

And my platinum level support provides that.

Additionally, if our staff can’t help you (which is rare) I will personally get involved and make sure you get whatever you need.

Everyone who joins today will get upgraded automatically to my platinum support level. And that is a value of $997.

We also offer platinum level support which we charge $997 a year for.

This enables you to call in and talk directly with our concierge team on the phone.

This is rare in our industry but there is nothing worse than having a trade issue and not being able to contact someone right away.

When you have money on the line you want answers now not tomorrow.

And my platinum level support provides that.

Additionally, if our staff can’t help you (which is rare) I will personally get involved and make sure you get whatever you need.

Everyone who joins today will get upgraded automatically to my platinum support level. And that is a value of $997.

steven

We typically see between 2-5 investment opportunities a month that meet our criteria.

As I said this is not a day trading service.

So if you're looking for a constant stream of trades this may not be for you.

As I said this is not a day trading service.

So if you're looking for a constant stream of trades this may not be for you.

michael

Man Steve, you are pulling out all the stops today.

So not only do we get your special report which outlines the three stocks that with just $500 in each could generate $11,105 in profit...

We also get access to your core service for a full year. And that will get us 2-5 new trade opportunities every month. That has a value of $4995

And to make sure none of us are left behind we also get your beginners course which has a $997 value.

And now you are upgrading us to your platinum support so if we need anything you and your team are just a phone call away. And that has a value of $997

So not only do we get your special report which outlines the three stocks that with just $500 in each could generate $11,105 in profit...

We also get access to your core service for a full year. And that will get us 2-5 new trade opportunities every month. That has a value of $4995

And to make sure none of us are left behind we also get your beginners course which has a $997 value.

And now you are upgrading us to your platinum support so if we need anything you and your team are just a phone call away. And that has a value of $997

steven

That's right Michael, all in all that is a total value of $18,094.

But I have to ask you all something…

Let’s look at just the 3 stocks in the bonus report.

If all it did was half of what I was expecting. That’s still over $5,500 with just a $500 investment in each stock.

Would getting 2-5 picks a month like that be worth it?

It’s simple math.

It's kind of like you handing me $18,094 and in return I hand you $5,500 a month for a year.

Let me simplify this.

Would you trade $18k for potentially $65k?

But I have to ask you all something…

Let’s look at just the 3 stocks in the bonus report.

If all it did was half of what I was expecting. That’s still over $5,500 with just a $500 investment in each stock.

Would getting 2-5 picks a month like that be worth it?

It’s simple math.

It's kind of like you handing me $18,094 and in return I hand you $5,500 a month for a year.

Let me simplify this.

Would you trade $18k for potentially $65k?

"

Would you trade $18k for potentially $65k?

"

Of course you would. (and that is without compounding by the way.)

I doubt you will just be trading $500 per trade for long.

Heck some of you are going to be trading way more than that right out of the gate.

Now listen When I was putting this package together I had two choices.

1, sell this very cheap and try to sell as many as possible.

The problem with that is we could end up with crowding and this could cause liquidity issues. That would not be fair to you nor I.

The second option is to charge a little more.

This keeps the numbers low so we don’t have to worry about liquidity.

But it also enables me to dedicate more time, energy and resources to ensure your success.

After all, what are 2-5 highly profitable investments per month worth to you?

Everyone is trading with different amounts so only you can answer that.

We already established the potential value of just the first three in our bonus report being over $11k with just a $500 investment in each.

With that in mind you can see why institutions who are trading with much more than $500 regularly pay me $10k a month to get access to these trades.

After all, it's not a cost. It's an investment.

You already know it's worth $18,094 and even at $4,995 (which is what I charge the public) it’s a great deal.

But because I am in a fantastic mood and I am super excited about these three trades, Today as a webinar discount you will only pay $1,997 for a full 12 months access.

So click over now to get registered

Get Instant Access Now!I doubt you will just be trading $500 per trade for long.

Heck some of you are going to be trading way more than that right out of the gate.

Now listen When I was putting this package together I had two choices.

1, sell this very cheap and try to sell as many as possible.

The problem with that is we could end up with crowding and this could cause liquidity issues. That would not be fair to you nor I.

The second option is to charge a little more.

This keeps the numbers low so we don’t have to worry about liquidity.

But it also enables me to dedicate more time, energy and resources to ensure your success.

After all, what are 2-5 highly profitable investments per month worth to you?

Everyone is trading with different amounts so only you can answer that.

We already established the potential value of just the first three in our bonus report being over $11k with just a $500 investment in each.

With that in mind you can see why institutions who are trading with much more than $500 regularly pay me $10k a month to get access to these trades.

After all, it's not a cost. It's an investment.

You already know it's worth $18,094 and even at $4,995 (which is what I charge the public) it’s a great deal.

But because I am in a fantastic mood and I am super excited about these three trades, Today as a webinar discount you will only pay $1,997 for a full 12 months access.

So click over now to get registered

You can also call 888-228-2376 we have operators standing by.

Now, I want to put this opportunity into perspective.

As I said, I typically charge institutions $10k a month to get access to this. Even retail clients pay $4997 to get access and that does not include the bonus items.

So the way I see it is you’ve got two choices.

Your first choice is to do nothing...

The last 30 minutes becomes a complete waste of your time and what do you get?...

Nothing.

Or... Take this leap of faith and give this a shot.

See for yourself.

It is possible to ethically steal these “In the know” investors' trades for potentially thousands of percent gains.

And look, if after the membership ends, if you have not made 10 times today’s investment.

My team and I will work another year for free.

michael

Hold on Steve, let me get this straight.

Let's say I sign up today and pay the $1,997.

Even if I make $19,000 over the next 12 months you are still going to work extend my access an entire extra year for free?

Let's say I sign up today and pay the $1,997.

Even if I make $19,000 over the next 12 months you are still going to work extend my access an entire extra year for free?

steven

That's right Michael, but don’t get your hopes up on that happening.

Imagine being the Chief Financial Officer of Coca-Cola... You know the earnings numbers before they come out.

The President of Asian operations just briefed you on next quarter’s expansion plans in China...

The M&A team just met down the hall to discuss their $4 billion bid for Vitamin Water...

You and the CEO are having lunch to discuss your upcoming earnings report...

Imagine being the Chief Financial Officer of Coca-Cola... You know the earnings numbers before they come out.

The President of Asian operations just briefed you on next quarter’s expansion plans in China...

The M&A team just met down the hall to discuss their $4 billion bid for Vitamin Water...

You and the CEO are having lunch to discuss your upcoming earnings report...

"With all that information at hand... with such intimate knowledge of every facet of your company and its future... how hard would it be to predict where your stock will be in the next 3, 6 or 12 months?"

This is the advantage insiders have over not only retail investors, but Wall Street as well.

And it is why I am so confident in the service.

But in the end it comes down to a simple question.

Is it worth investing a few minutes of your time each month to potentially make hundreds of thousands of dollars.

Heck even if the special report does half of what I expect, it will more than pay for your entire year. "

michael

So Steve, let me just confirm one last time everything I get when we register today and also I see a ton of questions coming in that we should probably take some time to answer.

First we get the special report that outlines the details of the three stocks you covered earlier. Stocks that with an investment as little as $500 in each could generate $11,105 in profit.

We also get access to your core service for a full year. And that will get us 2-5 new trade opportunities every month. That has a value of $4,995

And to make sure none of us are left behind we also get your beginners course which has a $997 value.

Additionally, you are upgrading all of us to your platinum support so if we need anything you and your team are just a phone call away. And that has a value of $997

So total value, all in. $18,094 and on this webinar only, Until the timer runs out. We can get it for just $1,997?

steven

Absolutely Michael.

But don't put this off.

Remember these stocks could take off at any moment from a surprise announcement and no one likes an “I told you so”

So either click over or call in now and lock in your package while you still can. 888-228-2376

Get Instant Access Now!But don't put this off.

Remember these stocks could take off at any moment from a surprise announcement and no one likes an “I told you so”

So either click over or call in now and lock in your package while you still can. 888-228-2376

michael

So guys… do we want to remain outsiders?

or

Do we want to be insiders?

It looks like it's time for us to make a choice…

or

Do we want to be insiders?

It looks like it's time for us to make a choice…

steven

I could not have said it any better, and as soon as you order, you’ll receive your username and password to the secure site where you can access our research...

And immediately download your report, “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits"

So click over now. Go to the link: https://www.insiders-exposed.com/go

And you can review all the details of the offer.

Again, if you prefer you can call in and we can take your order over the phone 888-228-2376.

Get Instant Access Now!And immediately download your report, “Covert” Investors Unmasked: How to Follow Corporate Insiders For Huge Profits"

So click over now. Go to the link: https://www.insiders-exposed.com/go

And you can review all the details of the offer.

Again, if you prefer you can call in and we can take your order over the phone 888-228-2376.