LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

Insider trading is legal…

And that should make you happy.

Here’s why:

The rules governing how insiders buy and sell their stock allow us to legally and ethically steal these powerful trade ideas…

And potentially stuff our pockets full.

But you can’t blindly follow every insider trade and stumble into profits…

And I’ll show you why in this new video.

Every time an insider buys or sells their stock, they have to file a 2-page document called a Form 4.

So just follow the Form 4 to profits, right?

Not always.

You see, many traders fall for a well-disguised trap on the Form 4. It looks like a legit purchase, but it’s something else entirely.

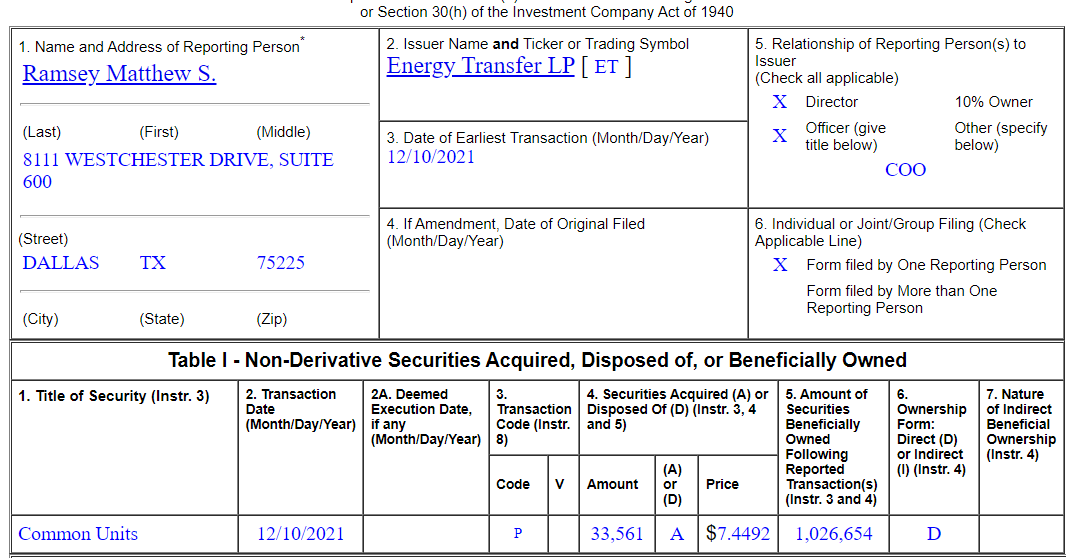

Let’s look at one of Energy Transfer LP (ET) COO Matthew Ramsey’s Form 4s:

Energy Transfer LP (ET) COO Matthew Ramsey’s Form 4s

According to the Form 4, it looks like Mr. Ramsey bought 33,561 shares of ET at $7.45.

In other words, he dumped a quarter million into his company…

Except he didn’t.

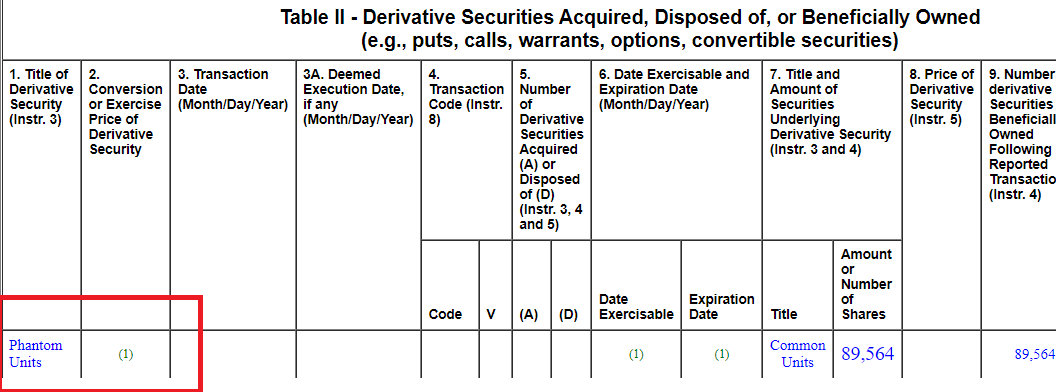

Take a look at the fine print:

Energy Transfer LP (ET) COO Matthew Ramsey’s Form 4s with Highlighted Phantom Units

It turns out Mr. Ramsey was converting “phantom units” of stock.

If you don’t know what those are:

Phantom units, or phantom stock, is a type of plan that gives someone a piece of potential upside in a company without giving them actual shares (and the accompanying voting rights).

Thus, they’re effectively non-voting shares.

These phantom units track the price of the real stock without the person actually owning that stock. This gives insiders an incentive to improve the company without diluting the stock value.

Without getting into the complexities: these insiders can then convert their phantom stock into real shares — kind of like exercising stock options.

And, as you saw above, it looks like a regular buy on Form 4 at first glance…

But remember: it’s not.

So it doesn’t tell us much about the insider’s conviction in their company’s potential upside.

Now, that doesn’t necessarily mean that ET is a bad play — it’s just not what we look for at Insiders Exposed.

If you want to learn how we find the real potential winners…