LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

We’ve proven countless times that following insiders can lead to huge potential wins. They know something others don’t… something that could send the company skyrocketing.

That’s how we made options gains of 109% on HIBB and 66% on CYCN over the past few months. We didn’t know what was happening inside the company, but we saw the insiders scooping up shares.

But you can’t just blindly trust insider buys, or you could see HUGE losses.

You see, a major trap traders fall into when following insiders is going after companies that recently made their way to exchanges — usually through IPOs or Special Purpose Acquisition Companies (SPACs).

Here’s the thing: when these companies get listed on exchanges, you’ll see tons of insider activity. It’ll look like tons of insider buying is happening…

But in reality, these “insider trades” are often related to executive compensation.

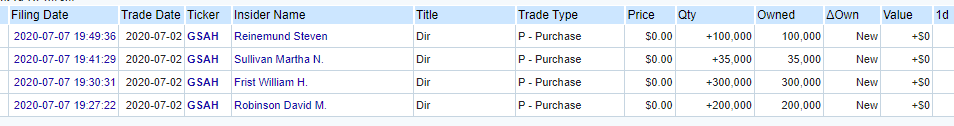

Take a look at GSAH, for example:

Insider Trader Information with how many stocks they have purchased

Buying at $0/share? How is that possible?

Well, that’s just the company allocating shares to executives — these aren’t straight-up purchases.

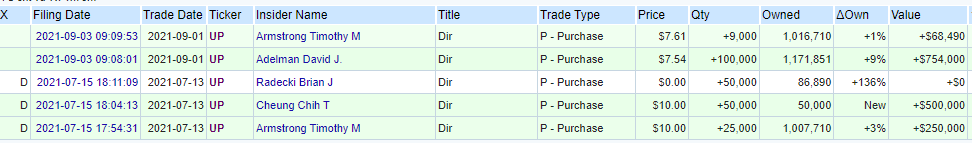

Let’s look at another stock, UP:

Insider Trader Information with how many stocks they have purchased

Wow, that’s a lot of insider purchases! Sure, 1 insider “bought” at $0/share, but the rest had to actually pay money...

Well, not exactly. This company recently IPO’d, so these are once again likely to be related to executive compensation.

Blindly following insiders can hurt you. The IPO/SPAC trap can destroy your profit potential if you don’t recognize what it is.

You need to know what you’re doing. Don’t blindly follow the insiders. Instead, you need to do your research — meaning a deep dive into each insider and their motivations for buying.

If that sounds like a lot of work to figure out for yourself…