LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

The all-important Fed minutes just hit us yesterday…

There was no surprise rate hike, but they did signal rate hikes this year…

And even a potential reduction in their balance sheet.

In response to this, the stock market started throwing a "tantrum" with more sellers coming into play.

And now, you’ll have a million financial media pundits begging for your attention.

They'll try to show you they are the smartest folks in the room with their Fed analysis and "will they or won't they."

I've made zero money guessing on Fed policy, and I don't base my investment decisions on rumors or press releases…

But I do know what does work:

A hidden indicator that most folks don't know about…

That shows up when conviction finally enters the market.

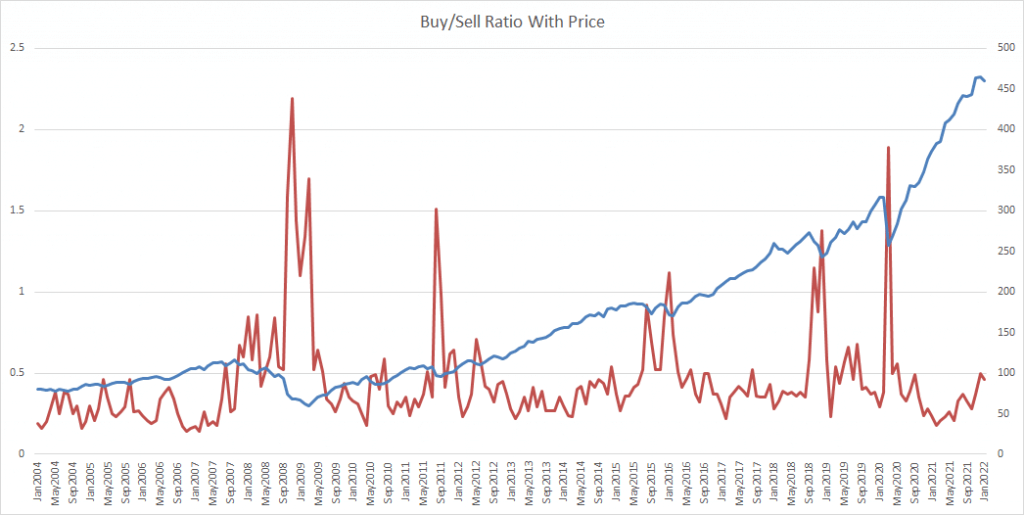

It's called the "buy/sell ratio."

But we're not just looking at stock prices to figure that out.

Instead, we look through "Form 4s" that show us when company insiders are buying or selling.

Before you ask:

Yes, it's perfectly legal to be an insider in the market…

As long as you disclose your buys and sells!

But we take this a step further:

We use a system that aggregates all the insider buys and sells in the market. With that, we get our buy/sell ratio.

Now, any time we see a large spike in this ratio…

It means insiders are buying in size…

And it has predicted several major lows in the market:

The red line represents the buy/sell ratio, while the blue line represents price.

We haven't seen enough of a selloff to bring out the insiders in size just yet...

But we can also watch the buy/sell ratio for individual sectors to get us a further edge.

Even without a massive spike, there are plenty of opportunities available.

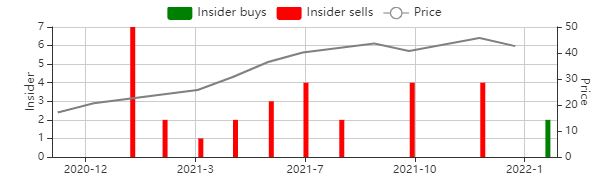

For instance, “meme stocks” have been hit hard recently…

But I just witnessed 4 high-level insiders at one of these “meme” companies buy in size at the same time 2 weeks ago. I issued my clients a trade alert once it was at a good price last week.

It’s still at a decent price, but who knows how long that could last.

Speaking of meme stocks, the king of them — GME — has been attempting a comeback via shifting to eCommerce.

That’s becoming more common with brick-and-mortar retailers.

In fact, one retailer on my watchlist is making the eCom pivot…

And 2 of its big-time insiders just bought within 2 days of each other…

After 2 years of nothing but selling from the rest of the insiders.

Here’s why I’m showing you these examples:

The media talking heads want you glued to your TV and dependent on them.

But you don’t need to do that at all.

By following what the insiders are doing, and paying attention to the buy/sell ratio…

You can stay calm and collected and dig up golden opportunities while the rest of the market freaks out.

What’s more:

I have a free training that dives deeper into legal insider trading and discusses how we follow insiders at Insiders Exposed.