LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

Wednesday night (early Thursday morning for Moscow), Russian President Vladimir Putin announced “Special Military Operations” in Ukraine.

In other words, invasion.

As a trader, it's very easy to fall into the trap of thinking you're an "expert" in everything. So I try my best to "stay in my lane" when it comes to foreign policy.

I'll even be the first to tell you that I didn't think Russia would create a full-blown conflict through the entire country.

Maybe slice off a piece of Donbas and call it a day.

Yet here we are with full incursions into Kiev.

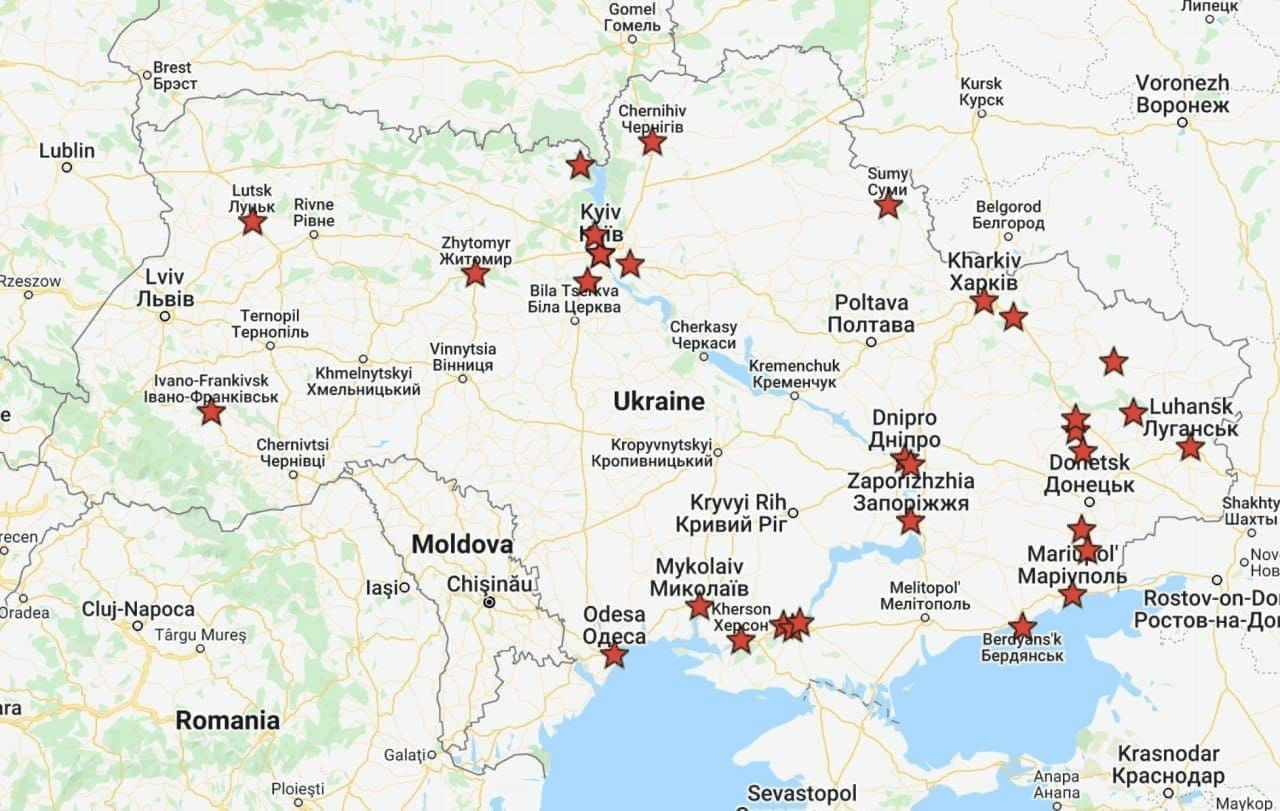

Map of Ukraine for reference (Kiev is also known as Kyiv):

Map of Ukraine

Now, I may not be a foreign policy genius…

But I am good at understanding how markets react to crises.

So today, I’ll walk you through some potential second-order consequences of this invasion to look out for. We’ll also take a look at some contrarian plays as we reach peak capitulation.

Conflicts between minor powers happen all the time. With Russia's GDP being on par with Italy, it's not small potatoes…

But it doesn't seem like it would be material to the US stock markets.

So why are we seeing a massive gap down on the Russian invasion?

It comes down to commodities.

Russia sends energy to Western Europe. If anything cuts that off, European energy costs shoot upwards.

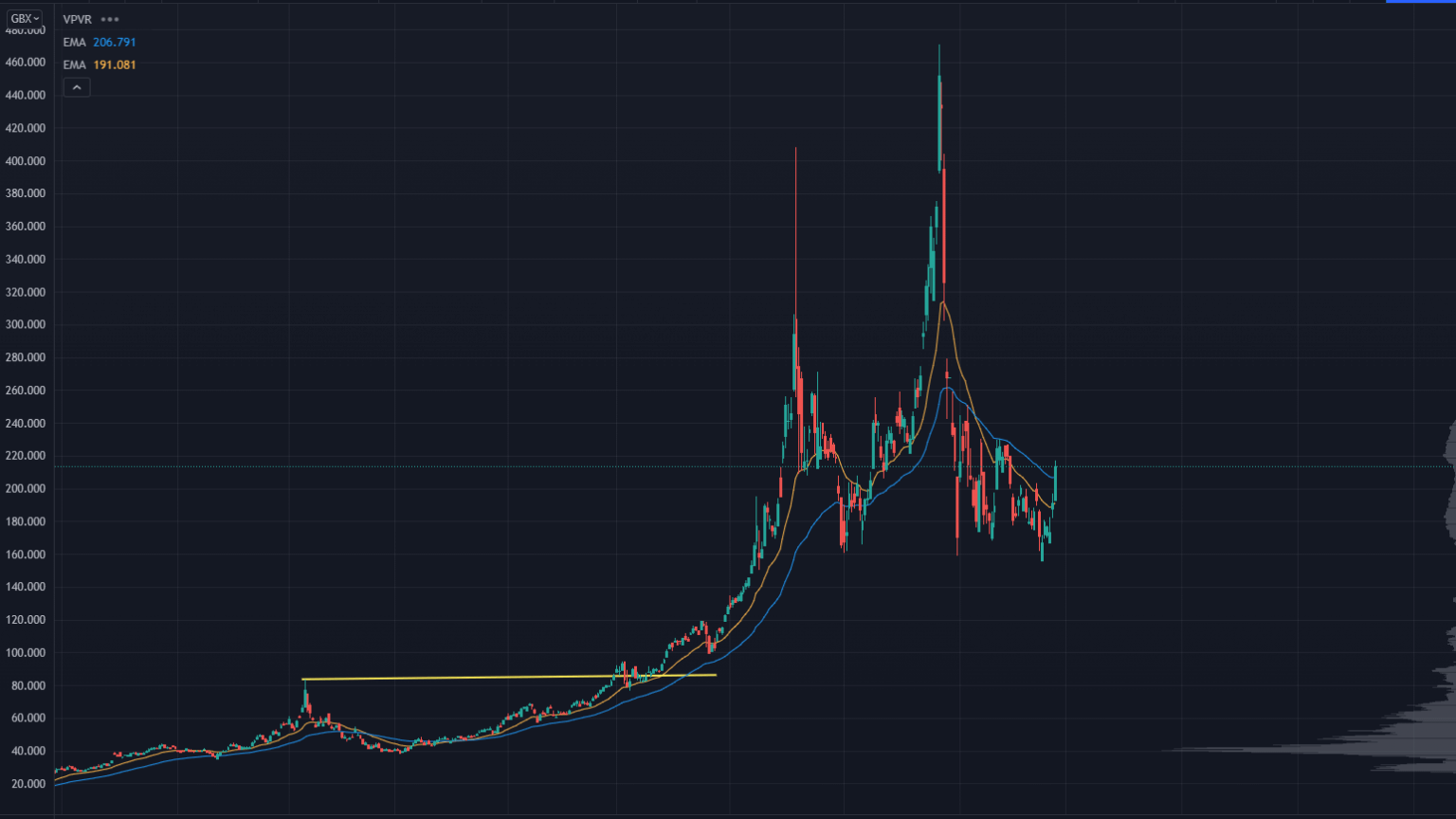

This comes on the back of massive price spikes in energy costs, too. Here's a look at GWM, which is the futures contract for natural gas in the UK:

GWM Chart

It doesn't stop with energy. Consider other commodities that could become an issue.

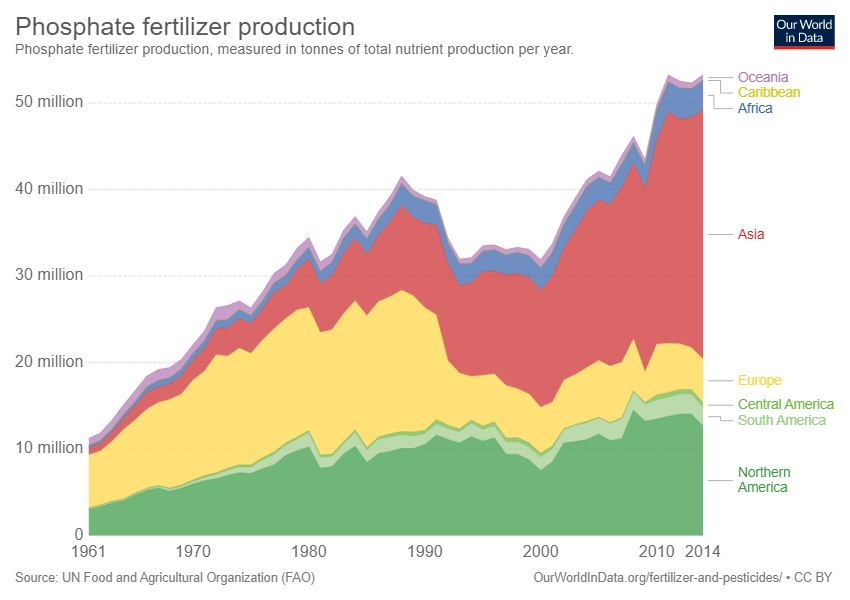

How about phosphate? We use that for fertilizer, which grows food.

Phosphate Fertilizer Production

China has already taken its phosphate offline until this summer. And back in November, Russia set quotas for nitrogen exports.

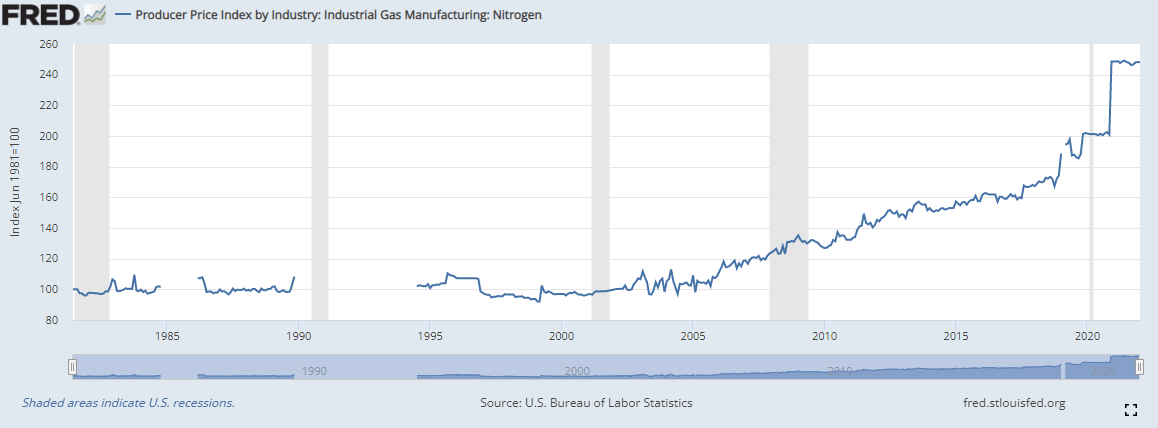

Here are current nitrogen gas prices:

Nitrogen Gas Prices

Next, we have normal agricultural commodities.

You may have heard that Ukraine is the "breadbasket of Europe." They are responsible for 10% of all global wheat exports.

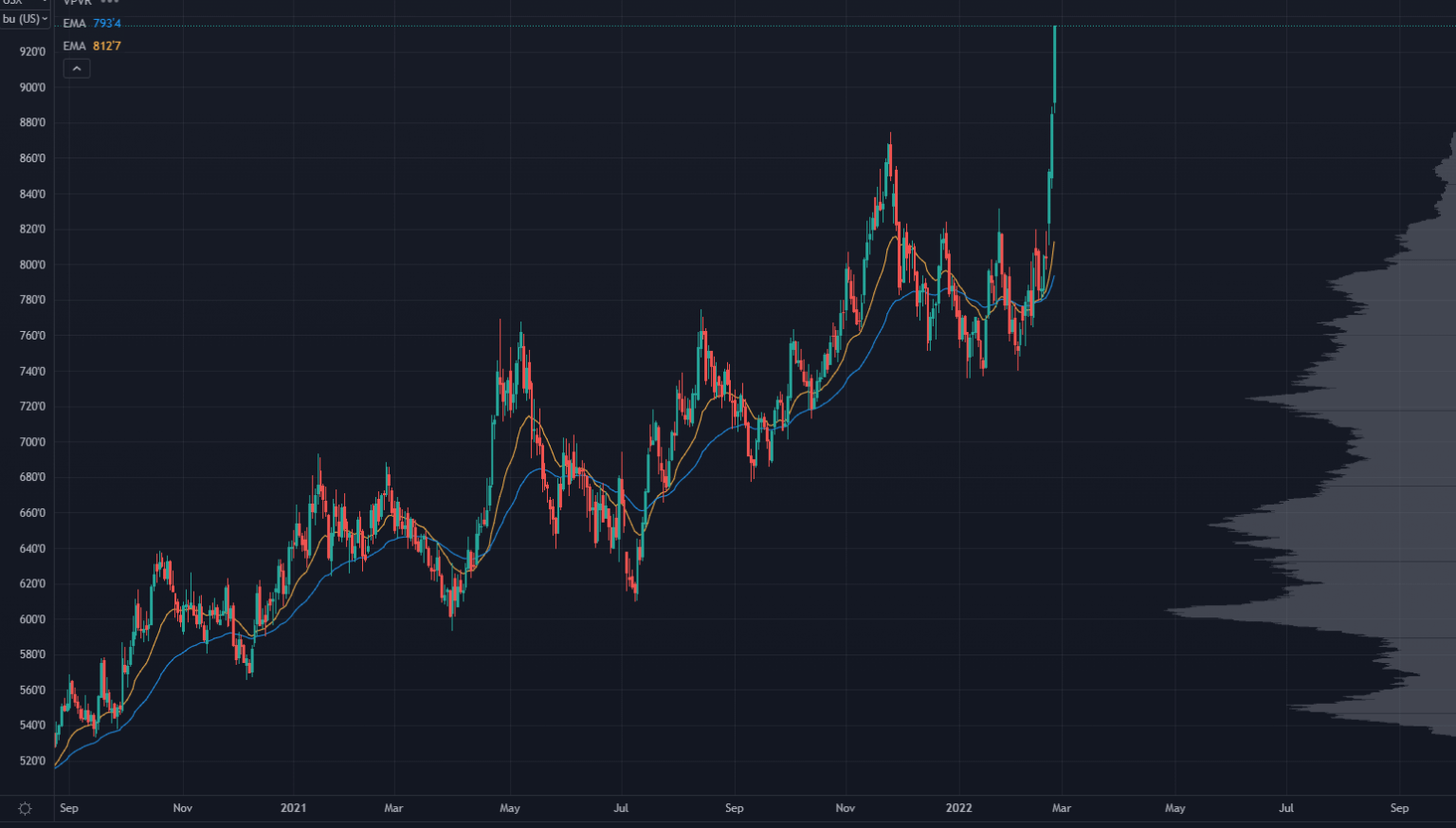

Here's what wheat futures are doing right now:

Wheat Futures Chart

That’s a hockey stick pattern.

The risk for equities should be plain to see now.

Disruption in commodity-producing countries is causing second- and third-order effects in other countries and markets.

We’ve had "supply chain" issues in the US...

Well, this is a global supply chain disruption.

Such disruptions lead to higher input costs, leading to inflation. And you know who’s concerned about inflationary pressures right now?

The Fed.

Back in November, they pivoted to discussing how inflation was no longer transitory and that they’ll have to be more aggressive in their policy shifts.

That kicked off the tech selloff, which bled over into the rest of the markets.

And now, with the disruption in Eastern Europe…

Central Banks will have to change their math on what inflation they should expect and what policy prescriptions may have to happen.

This right here is the reason the markets are spooked. It's not just about people dying — it's much more abstract than that.

Volatility in commodities — especially upside volatility — can lead to volatility in equities.

Now that we have a firm grasp on the narrative surrounding this crisis, we need to consider another question:

How much of a reaction have we already seen to this news?

Wars do not always mean lower stock prices. When the Iraq war kicked off, it marked the lows in the markets and kicked off the 2002 - 2007 bull run.

So try your best to stay neutral when thinking about how far we have to fall.

Many times, the market will have a "bathwater" setup: a point where we reach peak-bad-news, creating a tradeable low.

A good example was the 2018 tech wreck. Large-cap tech stocks were getting obliterated…

And then out of nowhere, AAPL changes earnings guidance and announces that they will no longer update iPhone unit sales.

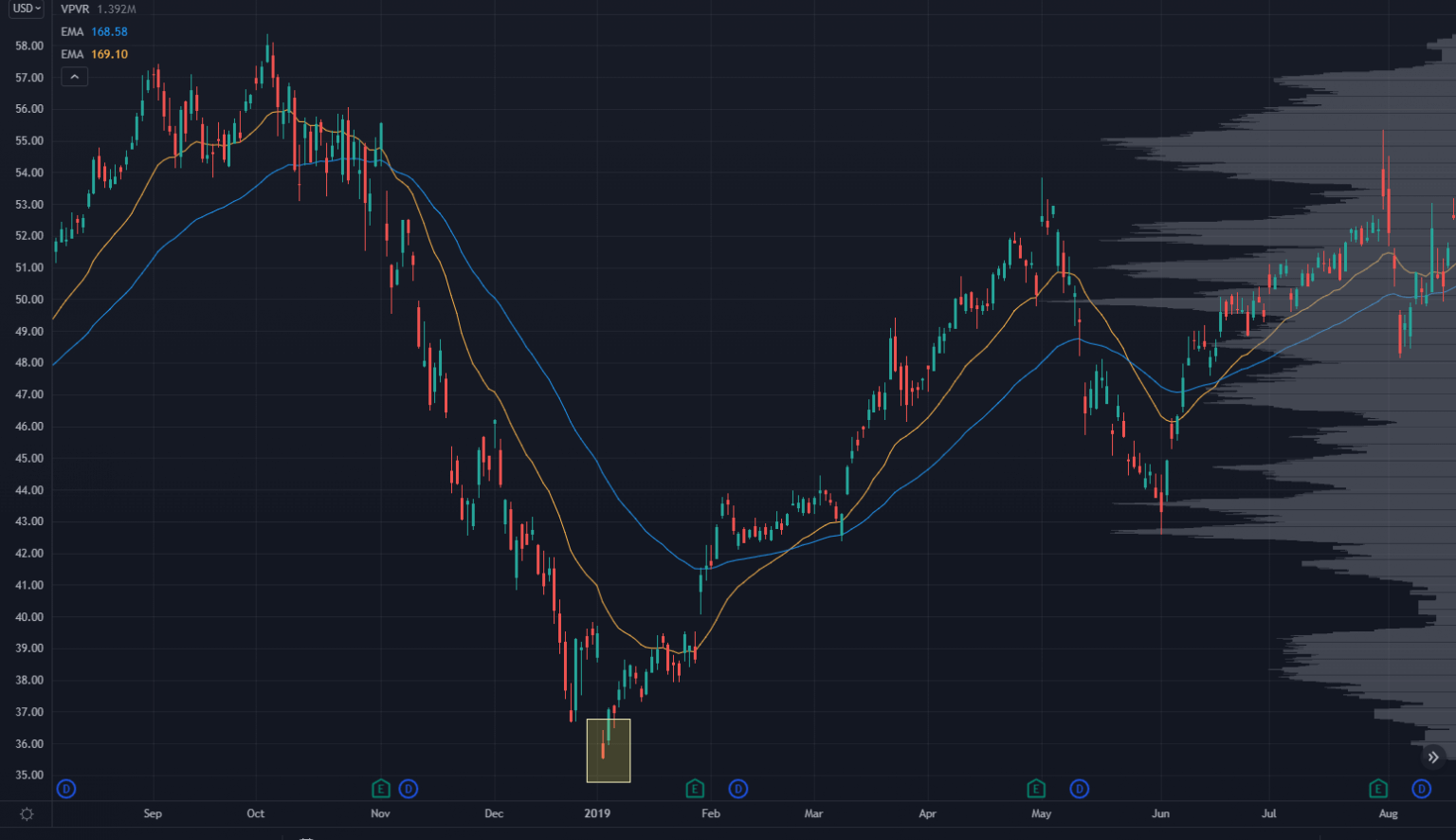

This led to a nasty gap down after a protracted downtrend, and was the low for the stock:

AAPL Stock Chart

There’s a very distinct possibility we’re getting close to peak narrative in the markets.

Everyone knows the Fed will raise rates by significantly this year. It's priced into the Fed Fund Futures.

Everyone knows that war in Ukraine will kick off a hard rally in commodities.

If we know all this and we see a puke in equities, this will *most likely* be a tradeable low.

The issue comes down to timing. You can be 3 days early to a market bottom, but that bottom might be another 5% lower than your entry.

That's the kind of uncertainty we are dealing with right now.

Fortunes are made and lost in these kinds of markets. There absolutely is a luck component involved, yet you can continue to stack the odds in your favor by doing a few things.

When market volatility is running hot, intermarket correlations run to 1.

That means it doesn't matter how good a stock picker you are — the name will move with the market.

You can avoid a lot of single stock risk by concentrating on the most liquid instruments available.

SPY, QQQ, IWM, DIA, VXX are the ones I’m focusing on, along with sector indices like SMH, XBI, and ARKK.

Buying 1,000 shares of a stock that's moving 3 points a day is quite different from buying when it's moving 10 points a day. You can adapt to the volatility conditions by shrinking your position sizing since you can earn just as much with smaller size on more movement.

If you’re fading this to the long side, understand that you're catching a knife and you’ll most likely take some heat on your trades.

So take your planned size and split it up, and look to add at better prices. Use the market to your advantage.

One school of thought in the options world believes that if the premium for puts gets very high, it becomes a "layup" trade.

Easier said than done. If you go down that road, make sure you've done that before, and you have plenty of dry powder in case things get weird.

Buying calls becomes a very attractive candidate when we get moves like this.

That’s because investors will sell calls against their positions into downtrends, depressing the implied volatility on the upside.

Yes, these options will seem expensive…

But you must understand that actual volatility will be more than the volatility priced into the market.

That means if you do want to take a shot to the long side, you’ll have much better risk/reward buying calls than with getting long straight stock or selling puts.

You should avoid short-dated options unless you're a very experienced daytrader.

Personally, I'm looking at about 60 days out and eyeing around the 30 delta strikes on the calls.

Some pockets in this market have been completely deleveraged. I'm thinking about some of the leveraged tech growth stocks that have been taken to the woodshed.

For example, PLTR is now under $10. ROKU is flirting with $100 per share after peaking at $450.

I don't want you to think you're entitled to owning the exact low on these companies. More liquidations can happen, especially if margin calls force a fund to sell.

However, there’s a very real possibility of hard bounces, to the point where call options become a very reasonable bet.

Just a few weeks ago, NET had a 50% rally before rolling over again.

If you can be disciplined and not marry a stock, there will be a point where you can really load the boat for an upside move.

Avoid going all in, cut your position sizing, and use volatility in your favor instead of blowing out of your positions right when the market takes a turn.

We've got a pretty clean layout of the risk in the markets right now, and we are coming close to a tradeable low.

Now, it comes down to personal psychology to make sure you don't screw it up.

Don't overleverage, don't go on tilt. Nobody’s forcing you to put on risk in this market, so you don’t have to if you don’t want to.

Have some humility and understand you’re not entitled to the exact best price in the market.

Focus on the most liquid names because liquidity will not be easily available. If you can navigate this properly, you've got the potential to make some nice returns in these uncertain times.

Stay safe out there!

Oh, one other thing that might be useful for weathering market volatility over the next several months:

Following corporate insiders.

It’s 100% legal for insiders to trade their own stock if they follow certain rules.

And thanks to those rules, you can piggyback off their every move — helping you find excellent setups in markets thrown off course by war in Eastern Europe.