LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

This month, SCOTUS decided to go scorched earth with some of the most “hot-button” political issues in America.

Those decisions and the social fallout have hogged the headlines and social media feeds across America.

Meanwhile, a little piece of financial news came out that should shock investors and traders everywhere.

Did you see it? Or did it get lost in the headlines about “peaceful protests” and responses from politicians?

Don’t worry. I got you covered.

It was so wild, that it broke the plumbing of the markets.

Turns out that Robinhood, the favorite broker among retail traders, was stuck in a nasty spot.

When GME was going wild, Robinhood was required to have over $3 billion in collateral. Total assets were about $700 million.

So they had to scramble for a short-term loan to post collateral so they wouldn’t fail…

And I have a feeling it would’ve taken a lot of people out.

We knew all of this already.

Yet a Congressional committee report came out with quite an interesting line:

“The report said Robinhood was ‘only saved from defaulting… by a discretionary and unexplained waiver’ granted by the DTCC following discussions between the agency and the brokerage.”

(Source: The Financial Times)

So the DTCC — the “high priests” of the market — called an audible after talking with Robinhood and the Feds.

This is a bombshell report that is not getting enough coverage…

And because the news services are dominated by political games, coverage won’t increase.

The Supreme Court news is substantive, but you can’t help but think media organizations are amplifying it to squeeze out news like this.

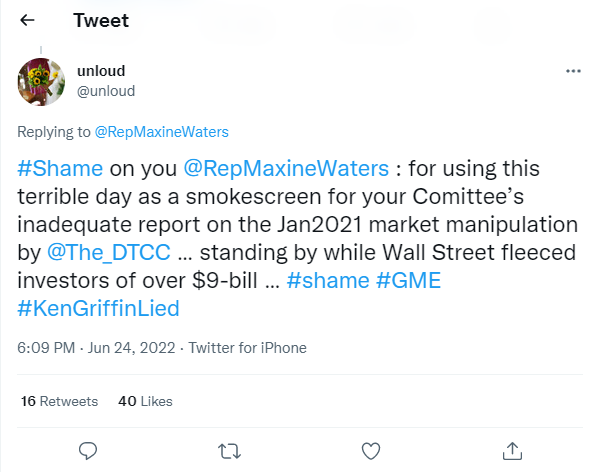

Even some opposed to the Supreme Court decisions believe so, like this tweet I saw:

Hey — if they let this news to the service, it would bring to the attention of Americans how the market is rigged against them in many cases.

In fact, corporate insiders are legally allowed to trade on material, non-public information, thanks to a tiny little SEC loophole.

And although we can’t access that information, there is a way to at least see the trade activities of these corporate elites…