LIMITED TIME OFFER - 10% off our service! Use promo code "IE10OFF" to save up to $200. Learn more or contact us here.

Back in 2013, Warren Buffett teamed up with a Brazilian company called “3G” to buy HJ Heinz, the ketchup company.

The purchase price was 19% higher than what the stock was trading at the close.

The day before the announcement, someone purchased a block of over 2,500 out of the money (OTM) calls for a capital outlay of about $90k.

The next day, those same calls were worth over $1.8 million.

Not bad for a trade, but this is the stupidest way to play it – trading options the day before a buyout will throw up a million red flags for the SEC.

That’s exactly what happened…

In February 2013, the SEC started hunting down those trades.

Turns out it was an overseas account linked to a trader… and that trader just so happens to have a brother in Brazil who knew about the buyout deal.

This is the stupidest way to try and break securities law.

If you’re an insider, you don’t have to try and sneak around. You just have to tell the SEC what you’re doing and disclose your trades.

See, there’s something called a 10b5-1, which is the trading plan an insider fills out and files with the SEC.

The “trading plan” is a very loose term, and they could justify the purchases for any reason whatsoever.

These trading plans aren’t public right now, but that could change if the new SEC chair has his way.

For now, we can find out when they trade and how much by looking at the “Form 4” the insiders they register with the SEC.

Let’s take a look at how to do it the right way.

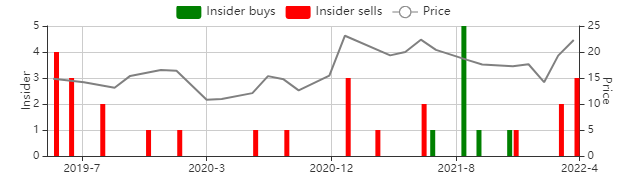

In Summer 2021, we spotted some insider buying on a cybersecurity company called Fireeye (FEYE).

These were the first purchases we had seen in a long time, and multiple insiders were buying at the same time (a phenomenon called a cluster buy):

Here’s where it gets interesting…

A few months before many of those insider buys, the company spins off its “Fireye Products Business” for 1.2 billion.

They then rebranded to a company called “Mandiant” and changed their ticker from FEYE to MNDT.

Consider this: You’ve got the Board President and COO, an EVP, and a Director all buying shares around $17…

And this is after they spun off a chunk of their business.

What are they doing?

Slimming down, so they can be more attractive to a buyer.

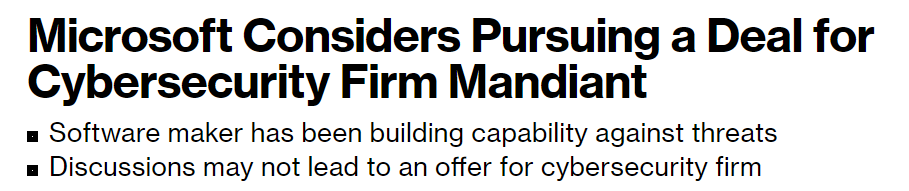

It took a few months, but this headline eventually dropped:

Those insiders, most of whom bought around $17, can now sell their shares at $22. That’s nearly 30% on a buyout trade.

All perfectly legal. They did the paperwork correctly, so the SEC can’t come after them – even if they knew the buyout was just around the corner.

Of course, clients at Insiders Exposed were able to follow along with MNDT trades for a tidy profit.

First, on this Microsoft news. We closed half our position, offering a 23.6% gain in just under 6 months.

But then, Google stepped in to fight with Microsoft for MNDT. Google won out and acquired MNDT – which allowed us to close the rest of our position for an easy 26% in 6 months.

Now, not all insider trades are created equal. Some don’t show very strong conviction, while others can actually be “traps” that look like buys… but aren’t.

To help you avoid that, I recorded a training that shows you 6 high-conviction insider trading setups.

Each setup is a strong indicator of upside potential in a name, and plenty play out every day across the market.